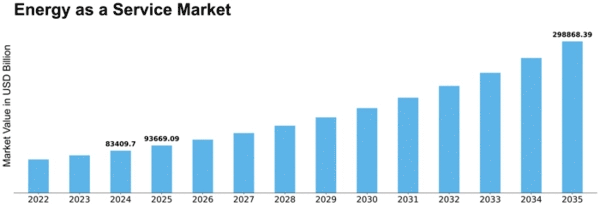

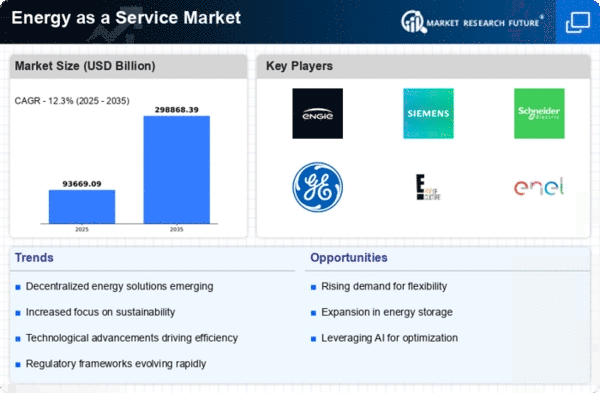

The Energy as a Service Market is currently experiencing a transformative phase, driven by the increasing demand for sustainable energy solutions and the need for businesses to optimize their energy consumption. This energy industry report provides a comprehensive analysis of trends, growth drivers, and competitive dynamics shaping the Energy as a Service market.

This market model allows organizations to access energy services without the burden of ownership, thereby promoting efficiency and reducing operational costs. As companies seek to enhance their sustainability profiles, the Energy as a Service Market appears to be a viable alternative, offering flexibility and scalability in energy management. Furthermore, advancements in technology, such as smart grids and energy storage systems, are likely to play a pivotal role in shaping the future landscape of this market.

The energy-as-a-service model is transforming how organizations procure, manage, and optimize energy without owning physical infrastructure. The global energy as a service EaaS market is witnessing rapid expansion, driven by sustainability goals and digital energy management adoption. The energy as a service model enables organizations to access integrated energy solutions through subscription-based or performance-linked contracts. The growing adoption of energy management as a service is driving demand for automated monitoring, analytics, and optimization solutions across enterprises.

In addition, regulatory frameworks and government incentives are fostering a conducive environment for the growth of the Energy as a Service Market. Policymakers are increasingly recognizing the importance of energy efficiency and renewable energy integration, which may lead to more favorable conditions for service providers. As organizations continue to prioritize sustainability and cost-effectiveness, the Energy as a Service Market is poised for significant expansion. The convergence of technological innovation and supportive regulations suggests a promising outlook for stakeholders in this evolving sector.

The growing adoption of EaaS energy solutions reflects a shift toward flexible, service-based energy procurement models. The adoption of efficiency-as-a-service in energy management is helping organizations reduce costs while achieving sustainability and performance targets. Several energy efficiencies as a service companies are expanding their offerings to include analytics-driven optimization and performance-based contracts. The rise of electricity as a service is enabling customers to access reliable power supply through flexible, outcome-based service agreements.

Increased Adoption of Renewable Energy Sources

The Energy as a Service Market is witnessing a notable shift towards renewable energy sources. Organizations are increasingly opting for solar, wind, and other sustainable options to meet their energy needs. This trend reflects a broader commitment to reducing carbon footprints and enhancing energy resilience.

The power as a service model is gaining traction among industrial and commercial users seeking predictable energy costs and improved efficiency. The Energy as a Service sector forms a key component of the broader energy services market, driven by digitalization and renewable integration. The energy services industry is undergoing rapid transformation as service-based energy delivery models replace traditional utility frameworks.

Integration of Smart Technologies

The incorporation of smart technologies into energy management systems is becoming more prevalent. These innovations enable real-time monitoring and optimization of energy usage, which can lead to improved efficiency and cost savings for businesses utilizing Energy as a Service.

Focus on Energy Efficiency and Cost Reduction

Organizations are placing a heightened emphasis on energy efficiency as a means to reduce operational costs. The Energy as a Service model supports this focus by providing tailored solutions that align with specific energy consumption patterns, ultimately driving down expenses.

The evolving energy services business is increasingly focused on long-term contracts, digital platforms, and sustainability-driven solutions. These energy market insights highlight the accelerating shift toward service-based energy procurement and renewable integration. The expansion of the Energy as a Service sector is supported by the rising global energy market size and increasing investment in sustainable infrastructure.

Leave a Comment