Top Industry Leaders in the Energy as a Service Market

Competitive Landscape of the Energy-as-a-Service Market:

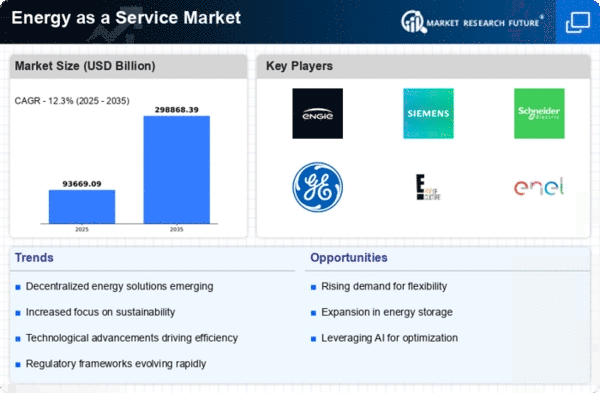

The Energy-as-a-Service (EaaS) market, still in its nascent stages, is experiencing explosive growth,. This dynamic landscape is populated by established players, disruptive newcomers, and a diverse range of strategies vying for market share. Navigating this terrain requires a clear understanding of the key players, their approaches, and the factors influencing their success.

Key Players:

- Johnson Controls (Ireland)

- Duke Energy (US)

- EDF Renewable Energy (UK)

- Edison International (US)

- Engie (France)

- Southern Company (US)

- Schneider Electric SE (France)

- General Electric (US)

- Siemens AG (Germany)

- WGL Energy (US)

- Orsted (Denmark)

- Enel X (Italy)

- SmartWatt (US)

- Bernhard Energy (US)

- Enertika (Spain)

- Honeywell (US)

- Veolia (France)

- Noresco (US)

- Wendel Energy Services (US)

Strategies Adopted:

- Specialization vs. Diversification: Some players focus on specific niches within EaaS, like solar PPAs or energy efficiency retrofits, while others offer a broader range of solutions. The choice depends on factors like target market, existing capabilities, and risk tolerance.

- Partnerships and Acquisitions: Collaboration and acquisitions are key strategies for expanding reach and expertise. Traditional utilities are partnering with technology leaders, while ESCOs are acquiring smaller players to gain access to new technologies and markets.

- Subscription-Based Models: EaaS providers are increasingly shifting towards subscription-based models, offering predictable revenue streams and customer lock-in. This approach aligns with businesses' preference for predictable energy costs and operational simplicity.

- Focus on Data and Analytics: Data-driven insights are crucial for optimizing energy usage and identifying cost-saving opportunities. Players are investing heavily in smart meters, energy management platforms, and AI-powered analytics to provide valuable insights to their customers.

Factors for Market Share Analysis:

- Geographical Focus: The EaaS market varies significantly across regions. Europe leads in terms of market size, but Asia-Pacific and North America are experiencing rapid growth due to supportive government policies and increasing energy demand.

- End-User Segment: Commercial and industrial sectors currently dominate the EaaS market, but residential adoption is expected to rise as awareness and affordability increase. Understanding the specific needs and challenges of each segment is crucial for tailoring offerings and achieving market share.

- Technology Adoption: Players offering advanced technologies like microgrids, energy storage, and AI-powered analytics are likely to gain an edge in the long run. Continuous investment in R&D and innovation is key for staying ahead of the curve.

- Regulatory Landscape: Government policies and incentives play a significant role in shaping the EaaS market. Players must consider factors like carbon pricing schemes, renewable energy mandates, and energy efficiency regulations when determining their market strategies.

New and Emerging Companies:

- A crop of startups is disrupting the EaaS landscape with innovative solutions. Companies like GridEdge are offering blockchain-based energy trading platforms, while others like LO3 Energy are providing community solar solutions. These newcomers are forcing established players to adapt and innovate to stay competitive.

Current Investment Trends:

- Renewable Energy: EaaS providers are increasingly investing in renewable energy generation assets like solar and wind farms to offer competitive PPAs and cater to growing demand for clean energy.

- Energy Storage: Investments in battery storage solutions are on the rise, as they provide grid stability and enable greater utilization of renewable energy sources.

- Digital Technologies: EaaS providers are pouring resources into developing intelligent energy management platforms, AI-powered analytics, and smart grid technologies to optimize energy usage and offer data-driven insights to customers.

Latest Company Updates:

In order to help businesses meet their decarbonization targets and increase the energy efficiency of their infrastructure, bp, a global integrated energy company, and Infosys, a leader in next-generation digital services and consulting, announced today that they have partnered to develop and pilot an energy as a service (EaaS) solution in 2021. Infosys and bp plan to work together to create a digital platform that can leverage artificial intelligence to optimise the supply and demand of energy for power, heat, cooling, and EV charging by gathering data from various energy assets.