Regulatory Compliance Requirements

The Employment Screening Services Market is significantly influenced by the evolving landscape of regulatory compliance. Organizations are increasingly subject to stringent regulations regarding employee screening, particularly in sectors such as finance, healthcare, and education. Compliance with laws such as the Fair Credit Reporting Act (FCRA) in the United States necessitates that employers conduct thorough background checks while adhering to legal standards. This regulatory environment compels businesses to engage employment screening services to ensure compliance and avoid potential legal repercussions. As a result, the demand for these services is expected to rise, with the market projected to reach a valuation of over 4 billion dollars by 2026. The Employment Screening Services Market thus stands to benefit from the growing emphasis on compliance and risk management.

Growing Awareness of Workplace Safety

The heightened awareness of workplace safety is a critical driver for the Employment Screening Services Market. Organizations are increasingly prioritizing the safety and well-being of their employees, leading to a greater emphasis on thorough background checks. This focus on safety is particularly pronounced in industries such as construction, healthcare, and education, where the implications of hiring unqualified or unsafe individuals can be severe. As a result, businesses are more likely to invest in employment screening services to ensure that they are hiring individuals who meet safety standards and possess the necessary qualifications. The market is projected to grow as organizations recognize the importance of creating a safe work environment, thereby driving demand for comprehensive screening solutions.

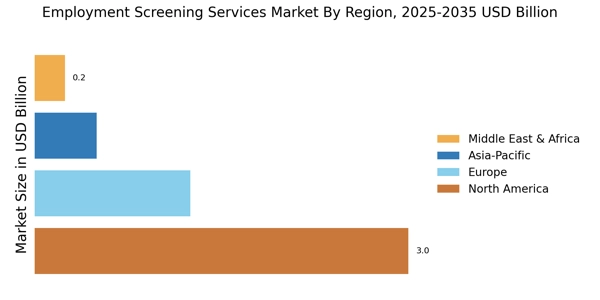

Rise of Remote Work and Global Hiring

The shift towards remote work and the expansion of The Employment Screening Services Industry. As companies embrace remote work models, they are increasingly hiring talent from diverse geographical locations. This trend necessitates comprehensive employment screening to verify the credentials and backgrounds of candidates from various jurisdictions. The market is likely to see a rise in demand for services that can navigate the complexities of international background checks, including compliance with local laws and regulations. This evolution in hiring practices suggests that the Employment Screening Services Market will need to adapt to meet the unique challenges posed by remote and global hiring, potentially leading to innovative service offerings.

Increasing Demand for Background Checks

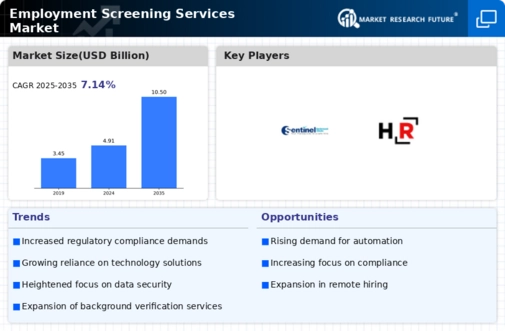

The Employment Screening Services Market experiences a notable surge in demand for comprehensive background checks. Organizations are increasingly recognizing the necessity of verifying candidates' credentials, criminal histories, and employment records to mitigate risks associated with hiring. According to recent data, the market for background checks is projected to grow at a compound annual growth rate of approximately 7.5% over the next five years. This growth is driven by heightened awareness of workplace safety and the need for organizations to protect their reputations. As businesses expand and diversify, the reliance on employment screening services becomes paramount, ensuring that they make informed hiring decisions. Consequently, the Employment Screening Services Market is poised for sustained growth as more companies prioritize thorough vetting processes.

Technological Integration in Screening Processes

The integration of advanced technology into the Employment Screening Services Market is transforming traditional screening processes. Innovations such as artificial intelligence and machine learning are streamlining background checks, enhancing accuracy, and reducing turnaround times. These technologies enable service providers to analyze vast amounts of data efficiently, thereby improving the overall quality of screening results. As organizations increasingly seek faster and more reliable screening solutions, the adoption of technology-driven services is likely to accelerate. The market is expected to witness a significant shift, with technology-driven employment screening services projected to account for a substantial share of the industry by 2027. This trend indicates a growing reliance on technological advancements to enhance the efficiency and effectiveness of employment screening.