Growing Awareness of Health and Safety

There is a rising awareness of health and safety among the general population, which is positively influencing the Emergency Medical Services Market. Public campaigns and educational programs are increasingly emphasizing the importance of immediate medical assistance in emergencies. This heightened awareness is leading to more individuals seeking emergency medical services when needed, thereby increasing service utilization rates. Furthermore, organizations are investing in training employees in first aid and emergency response, which complements the existing emergency medical services. Data indicates that communities with active health and safety programs report higher engagement with emergency services. Consequently, the Emergency Medical Services Market is likely to see sustained growth as public awareness continues to evolve.

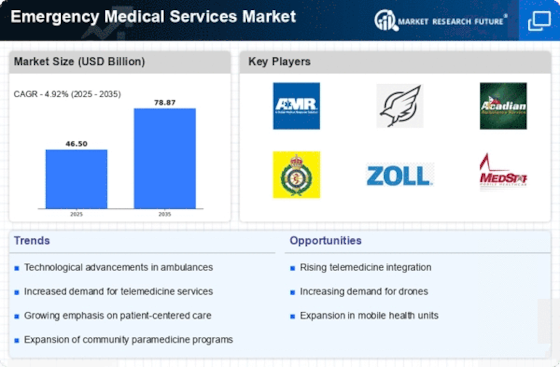

Increasing Demand for Emergency Medical Services

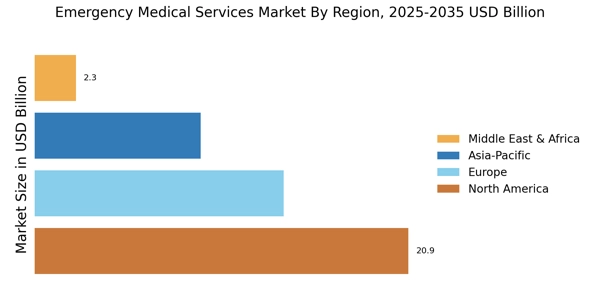

The Emergency Medical Services Market is experiencing a notable surge in demand, driven by a rising population and an increase in chronic diseases. As urbanization continues to expand, the need for timely and efficient emergency medical care becomes paramount. Reports indicate that the number of emergency calls has risen significantly, with some regions reporting increases of over 20% in the last few years. This heightened demand necessitates the expansion of emergency medical services, including the deployment of more ambulances and trained personnel. Furthermore, the aging population is likely to contribute to this trend, as older individuals typically require more frequent medical attention. Consequently, the Emergency Medical Services Market is poised for growth as healthcare systems adapt to meet these evolving needs.

Technological Advancements in Emergency Medical Services

Technological innovations are reshaping the Emergency Medical Services Market, enhancing the efficiency and effectiveness of emergency care. The integration of advanced communication systems, such as real-time data sharing and GPS tracking, allows for quicker response times and improved patient outcomes. Moreover, the adoption of telemedicine in emergency services is gaining traction, enabling paramedics to consult with physicians during transport. Data suggests that the implementation of these technologies can reduce response times by up to 30%, significantly impacting patient survival rates. As technology continues to evolve, the Emergency Medical Services Market is likely to see further enhancements, including the use of artificial intelligence for predictive analytics and resource allocation.

Regulatory Support and Funding for Emergency Medical Services

Government initiatives and regulatory support play a crucial role in shaping the Emergency Medical Services Market. Increased funding for emergency medical services is being observed, as governments recognize the importance of robust emergency care systems. For instance, various countries have implemented policies aimed at improving the infrastructure and training of emergency medical personnel. This financial backing is essential for upgrading equipment and expanding service coverage, particularly in underserved areas. Additionally, regulatory frameworks are evolving to ensure that emergency medical services meet high standards of care. As a result, the Emergency Medical Services Market is likely to benefit from enhanced operational capabilities and improved service delivery.

Integration of Mental Health Services in Emergency Medical Response

The integration of mental health services into the Emergency Medical Services Market is becoming increasingly relevant. As mental health issues gain recognition, emergency medical services are adapting to address these needs effectively. This shift involves training emergency personnel to recognize and respond to mental health crises, thereby improving overall patient care. Reports indicate that approximately 20% of emergency calls involve mental health-related issues, highlighting the necessity for specialized training and resources. By incorporating mental health services, the Emergency Medical Services Market can provide more comprehensive care, ultimately leading to better outcomes for patients. This trend suggests a potential for growth as services evolve to meet the complex needs of the population.