- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

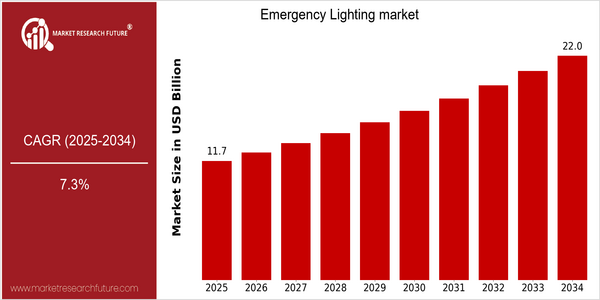

| Year | Value |

|---|---|

| 2025 | USD 11.67 Billion |

| 2034 | USD 22.0 Billion |

| CAGR (2025-2034) | 7.3 % |

Note – Market size depicts the revenue generated over the financial year

The world market for emergency lighting is expected to grow considerably, with a current market value of $11,670,000,000 in 2025, projected to reach $22,400,000,000 by 2034. CAGR of 7.3% for the forecast period. The growing emphasis on the importance of safety regulations and the growing demand for reliable emergency lighting solutions in various industries, such as commercial, industrial and residential, are the main drivers of this market growth. Furthermore, the development of LED technology and smart lighting systems will further increase the efficiency and effectiveness of emergency lighting, thus driving market growth. The major players in the emergency lighting market, such as Eaton, Schneider Electric and Philips Lighting, are actively investing in the development of new products and the establishment of strategic alliances to strengthen their market position. Product launches with a focus on energy-saving and sustainable lighting solutions, for example, have shown that the industry is moving towards more sustainable solutions. Also, the establishment of strategic cooperation with smart building technology companies has made it possible to integrate emergency lighting systems into smart building automation systems, thus increasing the adoption of emergency lighting systems in new construction and renovation projects. These trends will continue to shape the competition and market growth in the future.

Regional Market Size

Regional Deep Dive

The emergency lighting market is growing at a fast pace in all regions. The market is driven by a combination of technological advancements, government regulations and growing awareness about the need for emergency lighting. In North America, stringent building codes and increasing focus on the safety of the workplace are driving the demand for advanced emergency lighting solutions. In Europe, the focus is on energy-efficient and smart lighting solutions. The Asia-Pacific region is growing rapidly due to urbanization and rising spending on infrastructure. Middle East and Africa are growing fast due to government initiatives to improve public safety. And Latin America is adopting emergency lighting systems as a part of urban renewal projects.

Europe

- The European Union's Energy Efficiency Directive is pushing for the adoption of energy-efficient emergency lighting solutions, prompting manufacturers to innovate in LED technology.

- Companies such as Philips and Schneider Electric are leading the charge in developing smart emergency lighting systems that can be monitored and controlled remotely, improving response times during emergencies.

Asia Pacific

- Rapid urbanization in countries like India and China is driving the demand for emergency lighting in new construction projects, with government initiatives promoting safety standards.

- Local manufacturers are increasingly focusing on cost-effective solutions, while international companies like Signify are expanding their presence in the region to capture market share.

Latin America

- Emerging economies in Latin America are beginning to recognize the importance of emergency lighting in urban planning, with cities like São Paulo investing in public safety infrastructure.

- Local companies are partnering with international firms to enhance their product offerings, focusing on affordable and efficient emergency lighting solutions.

North America

- The National Fire Protection Association (NFPA) has updated its codes to emphasize the importance of emergency lighting in commercial buildings, leading to increased compliance and demand for advanced systems.

- Key players like Acuity Brands and Eaton are investing in smart emergency lighting solutions that integrate with building management systems, enhancing safety and energy efficiency.

Middle East And Africa

- Governments in the UAE and Saudi Arabia are implementing stricter safety regulations, which are boosting the demand for reliable emergency lighting systems in commercial and residential buildings.

- Projects like the Dubai Expo 2020 have highlighted the need for advanced emergency lighting solutions, leading to collaborations between local and international firms.

Did You Know?

“Approximately 70% of all fire-related deaths occur in homes, highlighting the critical role of emergency lighting in ensuring safety during emergencies.” — National Fire Protection Association (NFPA)

Segmental Market Size

The field of emergency lighting is of utmost importance in ensuring safety during power failures and emergencies. It is currently growing at a stable rate. The main growth factors are the growing number of regulations requiring emergency lighting in public and private buildings, and the rising awareness of consumers for the safety standards. Technological progress, such as the integration of LEDs and smart lighting, is further increasing the attractiveness of emergency lighting. The market penetration of emergency lighting is currently in its maturity phase, and there are many companies in the industry that lead in this field. Philips and Eaton are the most important companies in the field in most regions, especially North America and Europe. In the main application areas, i.e. in commercial buildings, medical institutions and public works, where it is essential to ensure a constant light, these companies have achieved a high level of market penetration. In the future, the development of smart lighting and the integration of emergency lighting with the Internet of Things will be important for the development of the industry.

Future Outlook

During the forecast period, the emergency lighting market is expected to grow at a CAGR of 7.3%. The growth will be driven by the increasing emphasis on safety regulations and standards in the residential, commercial, and industrial sectors. With increasing urbanization, the demand for reliable emergency lighting solutions will increase, especially in areas with high population density, where the risk of emergencies is high. By 2034, it is expected that emergency lighting systems will be used in 60% of new construction projects, up from 40% in 2025, as the industry focuses on safety and compliance with evolving building codes. Technological advancements will also play a key role in shaping the future of the emergency lighting market. The integration of smart lighting solutions with the Internet of Things (IoT) for real-time monitoring and control is expected to gain momentum. These systems not only enhance safety but also help to reduce energy consumption and align with global sustainable development goals. The increasing adoption of LED, which is known for its long life and low energy consumption, will further drive the growth of the market. As governments around the world continue to implement stricter policies on energy efficiency and safety standards, the market for emergency lighting is expected to grow.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 8.8 Billion |

| Market Size Value In 2023 | USD 9.4424 Billion |

| Growth Rate | 7.30% (2023-2030) |

Emergency Lighting Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.