Top Industry Leaders in the Electronic Grade Isopropyl Alcohol Market

Electronic Grade Isopropyl Alcohol Market

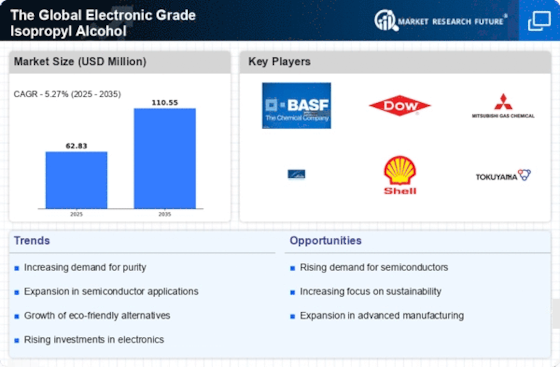

The global Electronic Grade Isopropyl Alcohol (IPA) market is a critical cleaning solvent, boasting exceptional purity levels, finds widespread application in the electronics industry, particularly for cleaning sensitive components in semiconductors, printed circuit boards (PCBs), and LCD displays. Understanding the competitive landscape, where established players and emerging forces duke it out for market share, is crucial for navigating this dynamic space. Let's embark on a 1000-word exploration, delving into key strategies, market share determinants, industry news, recent developments, and a market summary.

Strategies Shaping the Electronic Grade IPA Arena:

-

Capacity Expansion and Geographic Diversification: Major players like Dow Chemical, Tokuyama, and Mitsui Chemicals are expanding production capacities to cater to the surging demand, particularly in Asia Pacific. Regional expansions, exemplified by LG Chem's new plant in South Korea, aim to secure market share in high-growth areas.

-

Focus on Ultra-High Purity Grades: The demand for 99.99% and higher purity IPA for advanced semiconductor applications is rising. Companies like Jiangsu Denoir Technology are investing in specialized production facilities to meet this demand.

-

Technological Advancements: Continuous research and development efforts target sustainable and cost-effective production processes. Innovations like Fujifilm's water-recycling technology for IPA purification minimize environmental impact and optimize resource utilization.

-

Vertical Integration and Backward Integration: Leading players are integrating upstream and downstream in the supply chain to ensure raw material security and control over quality. For instance, Mitsui Chemicals produces both propylene and IPA, enhancing cost-competitiveness.

-

Strategic Partnerships and Collaborations: Collaborations with downstream manufacturers and distributors are on the rise. This fosters a secure supply chain, joint innovation, and wider market reach. Examples include Tokuyama's partnership with Shin-Etsu Chemical for IPA distribution in Japan.

Factors Influencing Market Share:

-

Production Capacity and Purity Levels: Large-scale production facilities and the ability to offer ultra-high purity grades are key differentiators. Companies like Dow Chemical with established global operations enjoy an edge.

-

Geographical Presence and Distribution Network: Strong presence in high-demand regions like Asia and robust distribution networks are crucial for wider market reach and efficient delivery.

-

Cost Competitiveness and Pricing Strategies: Balancing competitiveness with profit margins is a delicate dance. Efficient production processes and strategic pricing models are essential for success.

-

Quality Control and Regulatory Compliance: Maintaining stringent quality control and adhering to stringent regulations like USP and EP are vital for customer trust and market access.

-

Sustainable Production Practices: Customers increasingly prioritize environmentally responsible suppliers. Adopting sustainable technologies and minimizing waste can be a market advantage.

Key Players

- ExxonMobil

- LCY Chemical

- LG Chem

- Mitsui Chemicals

- Tokuyama

- Dow Chemical Company

- KMG Electronic Chemicals

- Hefei TNJ Chemical Industry Co., Ltd

- Linde Gas

- MG Chemicals

- Fujifilm

Recent Developments

-

September 2023: Fujifilm unveils its innovative water-recycling technology for IPA purification, reducing environmental impact and production costs. -

October 2023: LG Chem starts commercial production at its new IPA plant in South Korea, marking its entry into the Asian market. -

November 2023: A report by Market Research Future highlights the increasing demand for ultra-high purity IPA in advanced semiconductor packaging. -

December 2023: The American Chemical Society publishes research on a novel, sustainable method for IPA production using renewable resources.