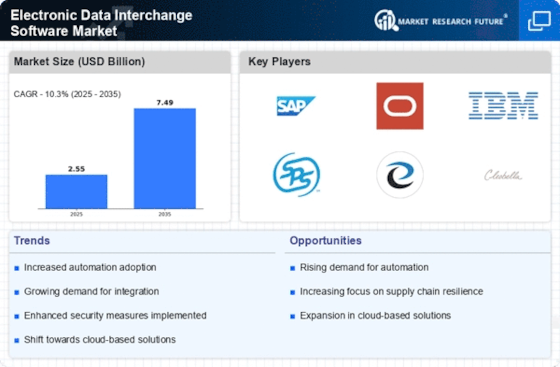

Top Industry Leaders in the Electronic Data Interchange EDI Software Market

Competitive Landscape of Electronic Data Interchange Software Market:

The Competitive Landscape of the Electronic Data Interchange (EDI) Software Market is characterized by intense rivalry and dynamic strategies adopted by key players. As businesses increasingly prioritize seamless data exchange, the demand for EDI software has surged, prompting companies to refine their approaches for sustained growth. The strategies employed by market players encompass a range of initiatives, including mergers and acquisitions, partnerships, and technological advancements. These efforts are aimed at gaining a competitive edge in the rapidly evolving EDI software market. Several factors contribute to the analysis of market share, ranging from product innovation and pricing strategies to customer service and global presence.

Key Players:

- Cleo

- Comarch SA

- Crossinx GmbH

- Data Masons Software LLC

- EDICOM

- IBM Corporation

- InterTrade Systems, Inc

- Mulesoft, LLC

- SPS Commerce, Inc.

- The Descartes Systems Group Inc.

- TrueCommerce Inc.

Key Strategies Adopted:

- Mergers and Acquisitions (M&A): Major players in the EDI software market have engaged in strategic acquisitions to expand their product portfolios and enhance their market presence. M&A activities allow companies to consolidate resources and integrate complementary technologies, fostering innovation and customer value.

- Partnerships and Collaborations: Establishing strategic partnerships with other technology providers, logistics companies, and industry-specific players has been a common strategy. These collaborations aim to create synergies, improve interoperability, and address the diverse needs of end-users across various sectors.

- Technological Advancements: Continuous investment in research and development has been pivotal for companies aiming to stay ahead in the competitive landscape. Innovations in areas such as cloud-based EDI solutions, blockchain integration, and artificial intelligence have been particularly prominent.

Factors for Market Share Analysis:

- Product Differentiation: Companies with a diverse and feature-rich product suite have a competitive advantage. The ability to offer customizable and scalable EDI solutions catering to the unique requirements of different industries enhances market share.

- Pricing Strategies: Effective pricing models that align with customer expectations and provide value for money contribute significantly to market share. Competitive pricing, bundled services, and flexible payment options are considerations that influence customer choices.

- Customer Service and Support: Excellent customer service, including responsive support, training programs, and user-friendly interfaces, enhances customer satisfaction. Positive experiences contribute to customer retention and word-of-mouth referrals, impacting market share.

- Global Presence: Companies with a global footprint and the ability to adapt solutions to regional and industry-specific requirements have a competitive edge. Market leaders often establish a strong international presence through subsidiaries, partnerships, or localized support centers.

New and Emerging Companies:

- Start-ups Focused on Niche Markets: Several start-ups have entered the EDI software market, targeting specific industries or providing specialized solutions. These companies aim to carve a niche for themselves by addressing unique challenges faced by their target customers.

- Technology Disruptors: Emerging companies leveraging emerging technologies such as blockchain or machine learning for EDI solutions are gaining attention. Their disruptive approaches challenge traditional players and force the market to evolve.

- SME-Focused Solutions: Companies focusing on delivering EDI solutions tailored for small and medium-sized enterprises (SMEs) are gaining prominence. These solutions often emphasize ease of use, affordability, and scalability, catering to the needs of a growing segment of businesses.

Current Company Investment Trends:

- Cloud-Based Solutions: Companies are investing heavily in cloud-based EDI solutions to offer greater flexibility, scalability, and accessibility to users. The shift towards cloud computing aligns with the broader trend of digital transformation across industries.

- Cybersecurity and Compliance: With an increased focus on data security and regulatory compliance, companies are directing investments towards enhancing the cybersecurity features of their EDI software. Ensuring secure data transmission and compliance with industry standards are top priorities.

- Interoperability and Integration: Investment in technologies that facilitate seamless integration with existing enterprise systems and enhance interoperability has become a key trend. Companies are striving to provide EDI solutions that seamlessly integrate with ERP systems, CRMs, and other essential business applications.

- User Experience Enhancement: Improving the user experience through intuitive interfaces and advanced functionalities is a common investment trend. Companies recognize the importance of user-friendly solutions in driving adoption and customer satisfaction.

Latest Company Updates:

In 2023, Integral Group's Electronic Data Interchange (EDI) technology has been acquired by Crisp, the top open-data platform for the retail sector. Nearly 40 years of EDI technology expertise and a strong platform that unifies order management, inventory, ERP, warehouse management, transportation management, and shipping workflows with other enterprise systems and applications are brought to Crisp by Integral Group.

2019 saw the acquisition of 1 EDI Source, Inc., a top supplier of business visibility software and electronic data interchange (EDI) solutions, by Epicor Software Corporation, a worldwide supplier of industry-specific enterprise software to support corporate growth. October 1st marked the closing of the deal. The agreement's financial terms were not made public.