Increasing Interconnection of Power Grids

The Electronic Components for HVDC System Market is influenced by the increasing interconnection of power grids across regions. As countries seek to enhance energy security and reliability, there is a growing trend towards interconnecting national and regional grids. HVDC technology facilitates this interconnection by allowing the transfer of electricity between grids that operate at different frequencies. This trend is expected to drive the demand for HVDC systems and, consequently, the electronic components that support these systems. The potential for cross-border electricity trading further amplifies this demand, indicating a promising outlook for the market.

Technological Innovations in HVDC Systems

Technological advancements play a crucial role in the Electronic Components for HVDC System Market. Innovations in power electronics, such as the development of advanced converters and control systems, are enhancing the efficiency and reliability of HVDC systems. These innovations are not only improving performance but also reducing costs, making HVDC solutions more accessible. The market is witnessing a trend where manufacturers are investing in research and development to create cutting-edge components that meet the evolving needs of HVDC applications. This focus on innovation is expected to drive market growth as new technologies emerge.

Growing Need for Efficient Power Transmission

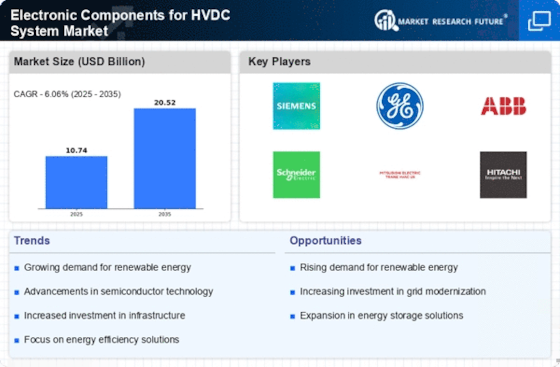

The Electronic Components for HVDC System Market is experiencing a surge in demand due to the increasing need for efficient power transmission. As energy consumption rises, traditional AC systems face limitations in long-distance transmission. HVDC systems, with their ability to transmit power over vast distances with minimal losses, are becoming more attractive. The market for HVDC technology is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This growth is driven by the need for reliable and efficient energy distribution, particularly in regions with renewable energy sources that are often located far from consumption centers.

Regulatory Support for Clean Energy Initiatives

The Electronic Components for HVDC System Market benefits from increasing regulatory support for clean energy initiatives. Governments worldwide are implementing policies that promote the adoption of renewable energy sources, which often necessitate the use of HVDC technology for effective integration. For instance, various countries have set ambitious targets for reducing carbon emissions, which has led to investments in HVDC infrastructure. The market is likely to see a boost as these regulations create a favorable environment for the deployment of HVDC systems, thereby enhancing the demand for electronic components that facilitate these technologies.

Rising Investment in Infrastructure Development

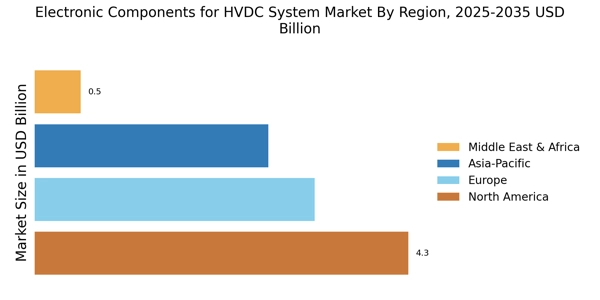

The Electronic Components for HVDC System Market is poised for growth due to rising investments in infrastructure development. Many countries are prioritizing the modernization of their energy infrastructure to accommodate the increasing demand for electricity. This includes the construction of new HVDC lines and the upgrading of existing systems. Investment in HVDC infrastructure is projected to reach substantial figures, with billions allocated to enhance energy transmission capabilities. Such investments are likely to create a robust demand for electronic components essential for the operation and maintenance of HVDC systems.