Electronic Cash Register Market Summary

As per Market Research Future analysis, the Electronic Cash Register Market Size was estimated at 7.2 USD Billion in 2024. The Electronic Cash Register industry is projected to grow from 8.093 USD Billion in 2025 to 26.05 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 12.4% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Electronic Cash Register Market is experiencing a transformative shift driven by technological advancements and changing consumer preferences.

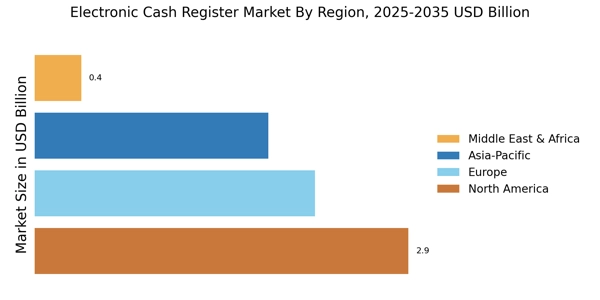

- The integration of advanced technologies is reshaping the Electronic Cash Register Market, particularly in North America.

- Data analytics is becoming increasingly vital for businesses to enhance operational efficiency and customer engagement in the Asia-Pacific region.

- The market is witnessing a notable shift towards mobile solutions, with portable systems emerging as the fastest-growing segment.

- Key drivers such as the rising demand for contactless payments and the integration of cloud computing are propelling growth across both stationary and mobile POS systems.

Market Size & Forecast

| 2024 Market Size | 7.2 (USD Billion) |

| 2035 Market Size | 26.05 (USD Billion) |

| CAGR (2025 - 2035) | 12.4% |

Major Players

NCR Corporation (US), Diebold Nixdorf (US), Toshiba Global Commerce Solutions (US), Sharp Electronics Corporation (JP), Casio Computer Co., Ltd. (JP), Wincor Nixdorf AG (DE), Epson America, Inc. (US), Zebra Technologies Corporation (US), PAX Technology Limited (CN)