Growing Demand for Convenience

The Electronic Bill Presentment and Payment Market is experiencing a notable surge in demand for convenience among consumers. As lifestyles become increasingly fast-paced, individuals seek efficient ways to manage their finances. The ability to receive and pay bills electronically offers a streamlined approach, reducing the time and effort required for traditional payment methods. According to recent data, approximately 70% of consumers prefer electronic billing due to its ease of use. This trend is likely to continue, as more individuals embrace digital solutions for their financial transactions. The convenience factor not only enhances customer satisfaction but also encourages timely payments, thereby benefiting service providers in the Electronic Bill Presentment and Payment Market.

Shift Towards Sustainable Practices

The shift towards sustainable practices is becoming a significant driver in the Electronic Bill Presentment and Payment Market. As environmental concerns gain prominence, consumers and businesses alike are seeking ways to reduce their carbon footprint. Electronic billing presents a viable solution by minimizing paper usage and promoting eco-friendly practices. Recent surveys indicate that over 60% of consumers prefer electronic bills to contribute to sustainability efforts. This growing preference is likely to encourage more companies to adopt electronic billing solutions, aligning their operations with environmentally conscious values. The Electronic Bill Presentment and Payment Market is thus positioned to thrive as sustainability becomes a core consideration for consumers.

Regulatory Support for Digital Transactions

Regulatory frameworks are increasingly supporting the transition to digital transactions, significantly impacting the Electronic Bill Presentment and Payment Market. Governments are implementing policies that encourage electronic payments, recognizing their potential to enhance efficiency and reduce costs. For instance, initiatives aimed at promoting cashless economies are gaining traction, with many countries setting targets for reducing cash transactions. This regulatory support is likely to drive the adoption of electronic billing solutions, as businesses and consumers alike seek to comply with new standards. The Electronic Bill Presentment and Payment Market stands to benefit from these developments, as they create a more favorable environment for digital payment solutions.

Technological Advancements in Payment Solutions

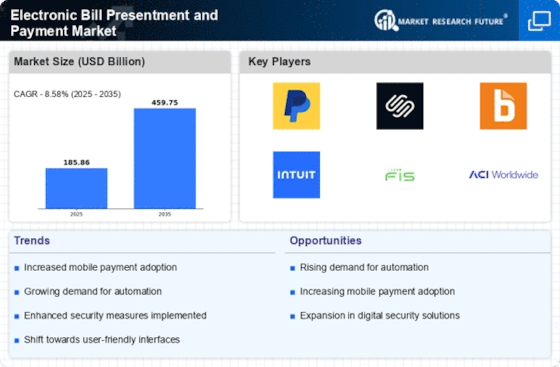

Technological innovations are playing a pivotal role in shaping the Electronic Bill Presentment and Payment Market. The integration of advanced payment solutions, such as contactless payments and mobile wallets, is transforming how consumers interact with their bills. Recent statistics indicate that the adoption of mobile payment solutions has increased by over 30% in the past year. These advancements not only enhance user experience but also improve transaction security, addressing consumer concerns about fraud. As technology continues to evolve, the Electronic Bill Presentment and Payment Market is likely to witness further enhancements, making electronic billing more accessible and secure for users.

Rising Consumer Awareness of Digital Financial Management

Consumer awareness regarding digital financial management is on the rise, influencing the Electronic Bill Presentment and Payment Market. As individuals become more educated about the benefits of managing their finances online, the demand for electronic billing solutions is expected to grow. Educational campaigns and resources are increasingly available, helping consumers understand the advantages of electronic payments, such as tracking expenses and reducing paper waste. This heightened awareness is likely to lead to increased adoption rates of electronic billing systems, as consumers seek to take control of their financial health. The Electronic Bill Presentment and Payment Market is poised to capitalize on this trend, as more individuals recognize the value of digital solutions.