Regulatory Compliance

Regulatory compliance is becoming a significant driver for the Electronic Article Surveillance System Market. Governments and regulatory bodies are implementing stringent guidelines to ensure the safety and security of retail environments. These regulations often mandate the installation of surveillance systems to protect both consumers and businesses. As compliance becomes a legal requirement, retailers are compelled to invest in electronic article surveillance systems to avoid penalties and ensure adherence to safety standards. This trend is likely to propel the market forward, as businesses recognize the importance of maintaining compliance while also enhancing their security measures. The intersection of regulatory requirements and security needs is expected to create a robust demand for electronic surveillance solutions in the retail sector.

Growing E-commerce Sector

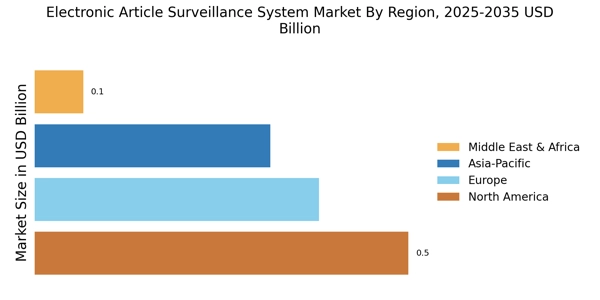

The rapid growth of the e-commerce sector is influencing the Electronic Article Surveillance System Market in various ways. As online shopping becomes increasingly popular, traditional retailers are compelled to enhance their in-store security measures to compete effectively. The need for a seamless shopping experience, coupled with the rise in click-and-collect services, has led retailers to invest in electronic surveillance systems that can monitor both in-store and online transactions. This trend indicates a shift in focus towards integrated security solutions that cater to the evolving retail landscape. Consequently, the Electronic Article Surveillance System Market is likely to benefit from the increasing demand for systems that can adapt to the changing dynamics of retail, ensuring that businesses remain secure in a competitive environment.

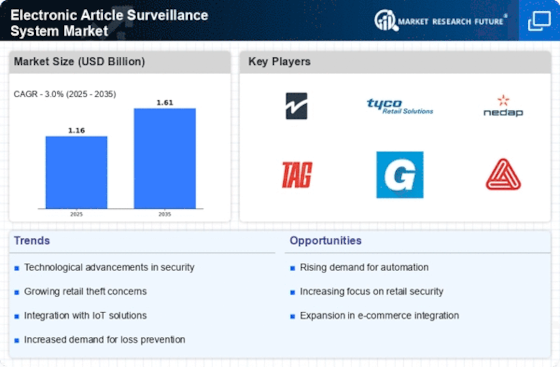

Rising Retail Theft Rates

The Electronic Article Surveillance System Market is experiencing a surge in demand due to increasing retail theft rates. Retailers are facing significant losses, with estimates suggesting that theft accounts for a substantial percentage of their annual revenue. This alarming trend has prompted businesses to invest in advanced surveillance systems to mitigate losses. The integration of electronic article surveillance systems is seen as a proactive measure to deter theft and enhance security. As retailers seek to protect their assets, the market for electronic surveillance solutions is likely to expand, driven by the need for effective loss prevention strategies. Furthermore, the rising awareness of the financial implications of theft is pushing retailers to adopt comprehensive security measures, thereby bolstering the Electronic Article Surveillance System Market.

Technological Advancements

Technological advancements play a pivotal role in shaping the Electronic Article Surveillance System Market. Innovations in RFID technology, for instance, have led to the development of more efficient and effective surveillance systems. These advancements enable retailers to track inventory in real-time, reducing the chances of theft and improving overall operational efficiency. The market is witnessing a shift towards integrated systems that combine various technologies, such as video surveillance and alarm systems, to provide a comprehensive security solution. As technology continues to evolve, the demand for sophisticated electronic article surveillance systems is expected to rise, as businesses seek to leverage these advancements to enhance their security protocols and protect their assets.

Increased Consumer Awareness

Increased consumer awareness regarding security and safety is significantly impacting the Electronic Article Surveillance System Market. Shoppers are becoming more conscious of their shopping environment, seeking assurance that retailers are taking adequate measures to protect their belongings. This heightened awareness is prompting retailers to adopt advanced electronic surveillance systems to enhance their security protocols. As consumers prioritize safety, businesses are recognizing the need to invest in effective surveillance solutions to build trust and loyalty. The demand for electronic article surveillance systems is likely to grow as retailers strive to meet consumer expectations and create a secure shopping experience. This trend underscores the importance of aligning security measures with consumer perceptions, ultimately driving the growth of the Electronic Article Surveillance System Market.