Top Industry Leaders in the Electrical Computer Aided Design Market

Competitive Landscape of Electrical Computer-Aided Design (ECAD)

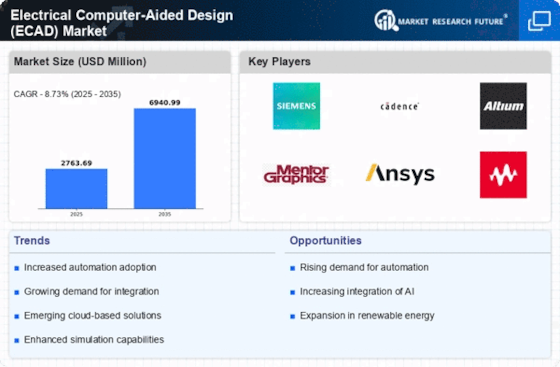

The Electrical Computer-Aided Design (ECAD) market, a crucial backbone for the electronics industry, is witnessing a dynamic shift in its competitive landscape. Driven by technological advancements, increasing demand for miniaturization, and the rise of the Internet of Things (IoT), This burgeoning market presents both opportunities and challenges for established players and emerging contenders alike.

Key Players:

- Zuken

- Autodesk Inc.

- Aucotec AG

- WSCAD

- Mentor Graphics (Siemens)

- Dassault Systèmes SE

- SIENNA ECAD Technologies

- IGE+XAO Group

- Trimble Inc.

- EPLAN Software & Service GmbH & Co. KG (EPLAN)

- Bentley Systems, Inc.

- ALPI International Software SA

- HEXAGON AB

- Cadence Design System Inc.

Strategies Adopted by Key Players:

- Established Giants: Companies like Siemens EDA, Mentor Graphics (Siemens PLM Software), Cadence Design Systems, Altium, and Synopsys reign supreme, capturing a significant market share. Their dominant position stems from years of experience, robust product portfolios encompassing various ECAD tools, and extensive global reach. Their strategies often revolve around continuous innovation, strategic acquisitions, and expanding into niche markets like automotive and high-performance computing.

- Open-Source Challengers: Open-source players like KiCad and EasyEDA are disrupting the market by offering free and readily available ECAD software. Their appeal lies in affordability and community-driven development, attracting hobbyists and small businesses. While open-source tools may not yet match the functionality of established solutions, their growing popularity and active development community pose a threat to traditional players.

- Cloud-Based Innovation: Cloud-based ECAD solutions, championed by companies like OnShape and Altium, are gaining traction. These solutions offer remote access, scalability, and collaborative design capabilities, particularly appealing to geographically distributed teams and smaller companies without dedicated IT infrastructure.

Factors for Market Share Analysis:

- Product Portfolio: The breadth and depth of a company's ECAD offerings, including schematic capture, PCB layout, simulation, and analysis tools, play a crucial role in market share. Diversification into specialized tools for specific industries like aerospace and medical devices can also provide an edge.

- Technological Innovation: Continuous investment in R&D, embracing emerging technologies like AI-powered design automation and cloud-native solutions, allows companies to stay ahead of the curve and cater to future market demands.

- Pricing and Licensing Strategies: Balancing robust functionality with competitive pricing is key. Flexible licensing options like subscription models cater to diverse user needs, while offering tiered features based on complexity can attract both budget-conscious and high-end users.

- Global Reach and Support: Strong customer support networks, multilingual capabilities, and regional customization of software are essential for success in a globalized market.

New Entrants and Emerging Trends:

- Start-ups with Niche Solutions: Several start-ups are focusing on specific areas like design optimization, integrated circuit (IC) design, and hardware-software co-design. Their agility and innovative solutions can disrupt established players in specific segments.

- Focus on User Experience: Intuitive interfaces, drag-and-drop functionality, and integration with other design tools are becoming increasingly important. Companies that prioritize user experience can attract new users and cater to a broader audience.

- Rise of AI and Machine Learning: AI-powered tools like automated routing, rule-checking, and design optimization are gaining traction. Companies that leverage AI effectively can improve design efficiency and accuracy, gaining a competitive edge.

Investment Trends:

- Cloud-based solutions: Major players and start-ups alike are heavily investing in cloud-based ECAD platforms, recognizing their potential for scalability, collaboration, and remote access.

- AI and Machine Learning integration: Investments are being made in integrating AI and machine learning capabilities into ECAD tools for automated tasks, design optimization, and predictive analysis.

- Cybersecurity and data protection: With increasing cloud adoption, investments are also focusing on robust cybersecurity measures to ensure data privacy and security.

Latest Company Updates:

The Manufacturing Intelligence division of Hexagon released HxGN Mould & Die in 2023. This is a set of specialised CAD/CAM (computer-aided design and manufacturing), engineering, and automation tools that enable mould and die and tool manufacturers to boost productivity and create high-quality tools for their clients in a variety of industries, including aerospace and automotive.

Customers of Altium CoDesigner Use Collaboration Between MCAD and ECAD to Speed Up Electronic Product Design in 2021. Printed circuit boards (PCBs) are only one component of electronic products. The boards are made by PCB designers within the framework of a particular device. To ensure that everything will fit precisely as intended when it comes to assembly, they must work closely with the mechanical engineers who design boards and their enclosures, including mounting holes and the positioning of crucial components.