Increasing Demand for Electric Vehicles

The Electric Vehicle Battery Electrolyte Market is directly influenced by the rising demand for electric vehicles. As consumers become more environmentally conscious, the shift towards electric mobility is accelerating. In 2025, the sales of electric vehicles are expected to surpass 10 million units, creating a substantial need for high-performance battery electrolytes. This demand is further fueled by government incentives and initiatives aimed at reducing carbon emissions. Consequently, manufacturers are compelled to enhance their electrolyte formulations to meet the performance requirements of next-generation electric vehicles, thereby driving growth in the electrolyte market.

Focus on Energy Efficiency and Performance

Energy efficiency remains a pivotal concern within the Electric Vehicle Battery Electrolyte Market. As automakers strive to improve the overall performance of electric vehicles, the role of electrolytes becomes increasingly critical. High-performance electrolytes can significantly enhance battery efficiency, leading to longer driving ranges and reduced charging times. This focus on performance is likely to propel investments in electrolyte research and development, as companies seek to differentiate their products in a competitive market. The emphasis on energy efficiency aligns with broader sustainability goals, further driving the demand for advanced electrolyte solutions.

Emerging Markets and Infrastructure Development

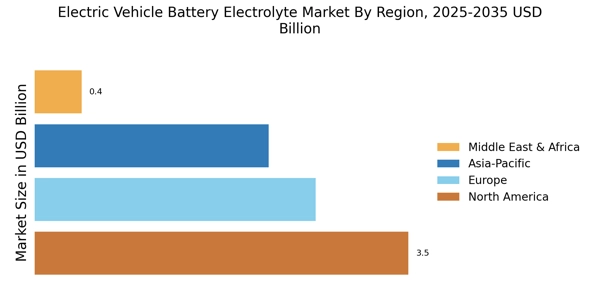

Emerging markets are becoming increasingly important for the Electric Vehicle Battery Electrolyte Market. As countries invest in electric vehicle infrastructure, including charging stations and battery recycling facilities, the demand for efficient battery electrolytes is expected to rise. These markets present unique opportunities for manufacturers to expand their reach and cater to a diverse consumer base. Additionally, the development of local supply chains for battery materials, including electrolytes, may enhance market dynamics. As infrastructure continues to evolve, the electrolyte market is likely to experience robust growth, driven by the increasing adoption of electric vehicles in these regions.

Technological Advancements in Battery Chemistry

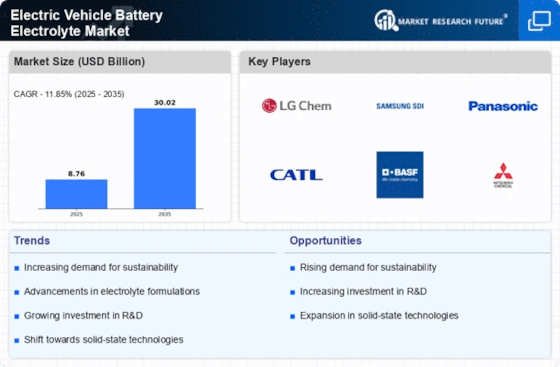

The Electric Vehicle Battery Electrolyte Market is experiencing a surge in technological advancements, particularly in battery chemistry. Innovations such as lithium-sulfur and solid-state electrolytes are gaining traction, potentially enhancing energy density and safety. These advancements may lead to longer-lasting batteries, which are crucial for consumer acceptance and adoption of electric vehicles. As manufacturers invest in research and development, the market is likely to witness a shift towards more efficient and sustainable battery solutions. According to recent estimates, the market for advanced battery technologies is projected to grow significantly, indicating a robust demand for innovative electrolytes that can support these new chemistries.

Regulatory Frameworks Promoting Electric Mobility

The Electric Vehicle Battery Electrolyte Market is benefiting from supportive regulatory frameworks that promote electric mobility. Governments worldwide are implementing stringent emissions regulations and providing incentives for electric vehicle adoption. These policies not only encourage consumers to switch to electric vehicles but also stimulate investments in battery technology, including electrolytes. As regulations become more favorable, manufacturers are likely to increase their production capacities for high-quality electrolytes, ensuring that they can meet the growing demand from the electric vehicle sector. This regulatory support is expected to play a crucial role in shaping the future of the electrolyte market.