Rising Environmental Awareness

The Electric Two-Wheelers MRO Market is significantly influenced by the growing awareness of environmental issues. As consumers become more conscious of their carbon footprint, the shift towards electric two-wheelers is accelerating. This trend is likely to result in an increased demand for MRO services tailored to electric vehicles. The market is expected to see a rise in service offerings that focus on sustainable practices, such as recycling of parts and eco-friendly maintenance solutions. According to recent studies, the electric two-wheeler segment is anticipated to account for a substantial portion of the two-wheeler market by 2030, further emphasizing the need for specialized MRO services. This heightened environmental consciousness is driving innovation within the Electric Two-Wheelers MRO Market.

Expansion of Charging Infrastructure

The Electric Two-Wheelers MRO Market is poised for growth due to the ongoing expansion of charging infrastructure. As more charging stations are established, the convenience of owning electric two-wheelers increases, which in turn boosts their adoption. This trend is likely to create a corresponding demand for MRO services, as more electric two-wheelers on the road will require maintenance and repair. Recent reports indicate that the number of charging stations is expected to double in the next five years, facilitating greater accessibility for electric vehicle users. Consequently, this infrastructure development is not only enhancing the user experience but also driving the growth of the Electric Two-Wheelers MRO Market, as service providers adapt to the needs of a growing customer base.

Regulatory Support for Electric Vehicles

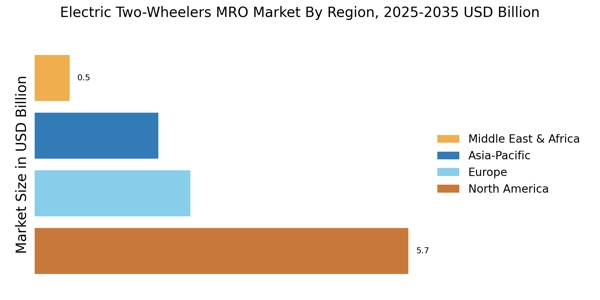

The Electric Two-Wheelers MRO Market is bolstered by supportive regulatory frameworks aimed at promoting electric vehicle adoption. Governments are implementing policies that encourage the use of electric two-wheelers, including tax incentives, subsidies, and infrastructure development. Such initiatives are likely to increase the number of electric two-wheelers on the road, subsequently driving demand for MRO services. For instance, recent regulations in various regions mandate the establishment of service centers specifically for electric vehicles, which could lead to a surge in MRO service providers. This regulatory environment not only fosters market growth but also ensures that the Electric Two-Wheelers MRO Market is equipped to handle the unique maintenance needs of electric vehicles.

Increased Investment in Electric Mobility

The Electric Two-Wheelers MRO Market is benefiting from increased investment in electric mobility solutions. Investors are recognizing the potential of electric two-wheelers as a sustainable transportation option, leading to a surge in funding for manufacturers and service providers alike. This influx of capital is likely to enhance the capabilities of MRO services, enabling them to adopt cutting-edge technologies and improve service offerings. Recent data suggests that investment in electric mobility is projected to reach unprecedented levels, with billions allocated to research and development. This financial backing not only supports the growth of electric two-wheelers but also strengthens the Electric Two-Wheelers MRO Market, as service providers are better equipped to meet the demands of an evolving market.

Technological Integration in MRO Services

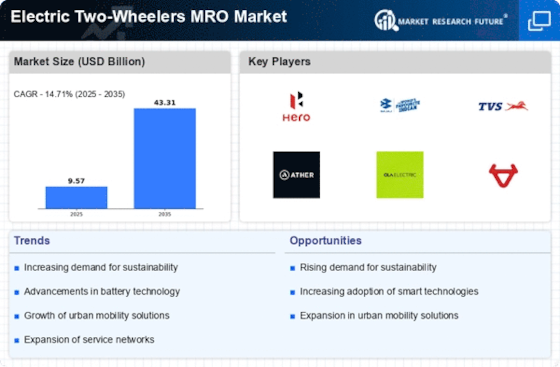

The Electric Two-Wheelers MRO Market is experiencing a notable shift due to the integration of advanced technologies. Innovations such as predictive maintenance, IoT connectivity, and AI-driven diagnostics are enhancing service efficiency and accuracy. These technologies enable service providers to anticipate maintenance needs, thereby reducing downtime and improving customer satisfaction. As electric two-wheelers become more prevalent, the demand for sophisticated MRO services is likely to increase. The market for electric two-wheeler maintenance is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 15% in the coming years. This technological evolution not only streamlines operations but also positions service providers to better meet the evolving needs of electric vehicle users.