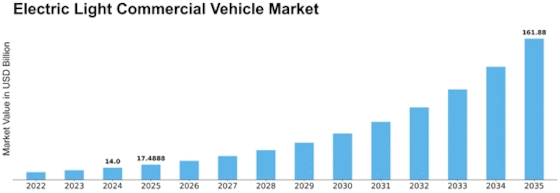

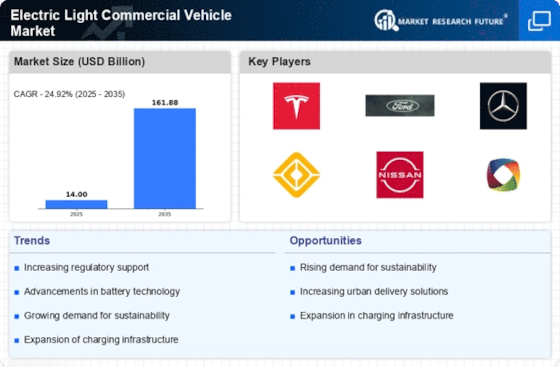

Electric Light Commercial Vehicle Size

Electric Light Commercial Vehicle Market Growth Projections and Opportunities

The electric light commercial vehicle (eLCV) market is undergoing a transformative switch in market dynamics as the auto mobile sector worldwide increasingly embraces electrification. This classification, which includes vans and small trucks, has witnessed a very high demand due to multiple factors which have influenced it. First of all, an increasing focus on sustainable environmental friendly transport solutions has motivated businesses to consider electric vehicles (EVs) over their traditional internal combustion engine analogues leading to this change. This transition coincides with global efforts towards minimizing carbon emissions and fighting climate change.

Additionally, progress in battery technology has improved eLCVs’ range and performance significantly since early days of electrification when potential buyers had numerous concerns. Given that battery costs keep going down, the price for electric cars overall becomes more competitive enabling wide adoption by the commercial sector. ELCVs total cost of ownership – encompassing elements such as maintenance expenses and fuel charges - continues being more advantageous compared to those entailing owning conventional vehicles thereby making them highly appealing options for operations oriented investments.

Government policies and incentives are other crucial determinants of eLCVs’ market landscape dynamics. Many nations have introduced strict emission regulations coupled with subsidies supporting EV adoption. Policy initiatives like these act as a catalyst forcing companies into integrating eLCVs into their fleets while others focus on creating charging infrastructure so that EVs can be commonly used hence addressing range anxiety among prospective consumers.

The changing consumer preferences and attitudes towards sustainability also affect the markets dynamics. The increasing awareness concerning the environment will present a challenge for businesses that need to show their commitment towards eco-friendly practices. Therefore consumer behavior has changed whereby they prefer products and services from firms adopting sustainable methods.

However, there are still challenges related to limited charging infrastructure, concerns about battery recycling, and initial capital costs that remain despite positive developments in recent years.

Leave a Comment