Market Analysis

In-depth Analysis of Electric Light Commercial Vehicle Market Industry Landscape

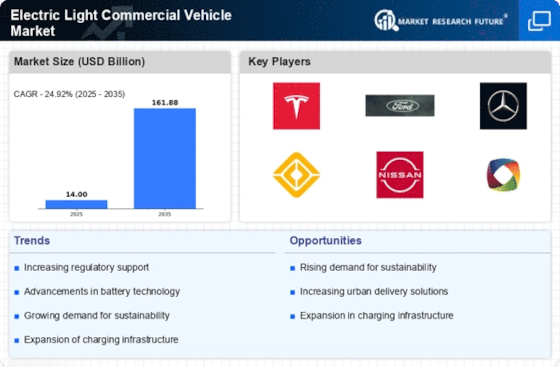

Currently, the electrical light commercial vehicle market is undergoing fundamental changes resulting from various underlying forces shaping its dynamics. One key aspect fueling this boom is growing concerns on environmental sustainability globally leading to reduced carbon emissions being emphasized upon by governments around the world had necessitated the tightening of pollution control regulations and the adoption of cleaner modes of transport including EVs targeting LCVs.

Moreover, battery technology advancements have been instrumental in the growth of electric light commercial vehicle market. The development of highly efficient batteries has solved a long-standing issue with low driving range making EVs workable for businesses. Not only has this breakthrough made electric light commercial vehicles more efficient but also made them cost-effective for fleet operators who want to reduce operating expenses within their cars’ lifetime.

On the other hand, one market force that affects this segment is changing customer preferences. Due to increased environmental awareness and a preference for sustainability, companies and individuals are now moving toward electric vehicles. This change in taste among customers is therefore forcing manufacturers into investing in Electric Vehicle technology resulting to a wider range of Electric Light Commercial Vehicles (LCVs) available across the market today.

The growth of electric light commercial vehicle market is being further stimulated by the availability of government incentives and subsidies. Various countries are providing financial incentives, tax exemptions and refunds to facilitate usage of electric vehicles. These incentives lower initial buyer’s cost and also contribute to their price levels, which in turn make them more attractive for both business people and individuals generally.

Besides, charging stations that support electric vehicles are increasing daily. This is vital in ensuring that electric light commercial vehicles becomes a success because it deals with issues such as distance worry or how easily cars can be charged. Governments as well as private sector players have injected huge amounts of funds into the development of charging networks leading to wide penetration and acceptance levels for commercial EVs.

There are global economic trends which shape the market for e-LCVs. The costs for traditional corporate fleets may depend on varying prices for various fuels due to oil oscillations and geopolitical factors alongside economic uncertainties. As upfront investments become comparable to those needed for ICEVs (Internal Combustion Engine Vehicles) and efficiency gains are realized, companies may find them more appealing than conventional fuel-driven fleet in times when energy prices are highly volatile.

Leave a Comment