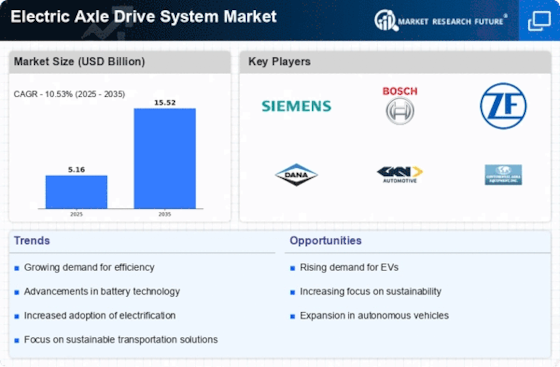

Leading market players are investing heavily in research and development in order to spread their product lines, which will help the Electric Axle Drive System market grow even more. Market participants are also undertaking a various strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Electric Axle Drive System industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Electric Axle Drive System industry to benefit clients and increase the market sector. In recent years, the Electric Axle Drive System industry has offered some of the most significant advantages to the automobile industry.

Major players in the Electric Axle Drive System market, including ZF Friedrichshafen AG (ZF), Dana Ltd., HELLA, Toyota Industries, Meritor Inc., Manga Iinternational Inc., Continental AG, Ziehl Abegg SE, Robert Bosch GmbH, American Axle & Manufacturing Holdings, Borgwarner Inc., GKN Plc, and others, are trying to increase market demand by investing in research and development operations.

Dana is a leading designer and manufacturer of highly efficient propulsion and provides energy-management solutions that power vehicle and machines in all mobility markets throughout the world. It is based in Maumee, Ohio, USA, founded in 1904, was named one of 'America's Most Responsible Companies 2023' by Newsweek because of its emphasizes on sustainability and social responsibility and its conventional and clean-energy solutions it provides in drive and motion systems; electrodynamics technologies, consisting of software and controls; thermal, sealing, and digital solutions.

In September 2021, Dana Ltd. introduced the eS9000r EV E-Axle for numerous Class 7 & 8 medium and heavy-duty vehicles, which will in the future advance the adoption of electric motility in the commercial vehicle segment.

ZF Friedrichshafen AG (ZF) is a global technology company providing systems for passenger cars, commercial vehicles, and industrial technology that allows the next generation of mobility with vehicle motion control, integrated safety, automated driving, and electric mobility. Their products contribute to minimizing emissions, protecting the climate, and improving safe mobility. It operates in over 32 countries with 165,000 employees globally.

In February it announced that in September 2023, it would start producing its first 800V electric drive axle in Hangzhou's Xiaoshan district. The development process was overseen by the local team from ZF's Electrified Powertrain Technology division in Shanghai.

It made almost $300 million investment in this factory.