Government Initiatives and Policies

Government initiatives and policies play a crucial role in shaping the Education Loans Market. Various countries have implemented programs aimed at making higher education more accessible through subsidized loans and grants. For instance, some governments offer income-driven repayment plans that adjust monthly payments based on borrowers' income levels. These initiatives not only encourage enrollment in higher education but also alleviate the financial burden on students. Recent statistics suggest that government-backed loans account for a significant portion of the education loan market, indicating the importance of public policy in driving market growth. As governments continue to prioritize education funding, the Education Loans Market is likely to benefit from increased loan availability and favorable repayment terms.

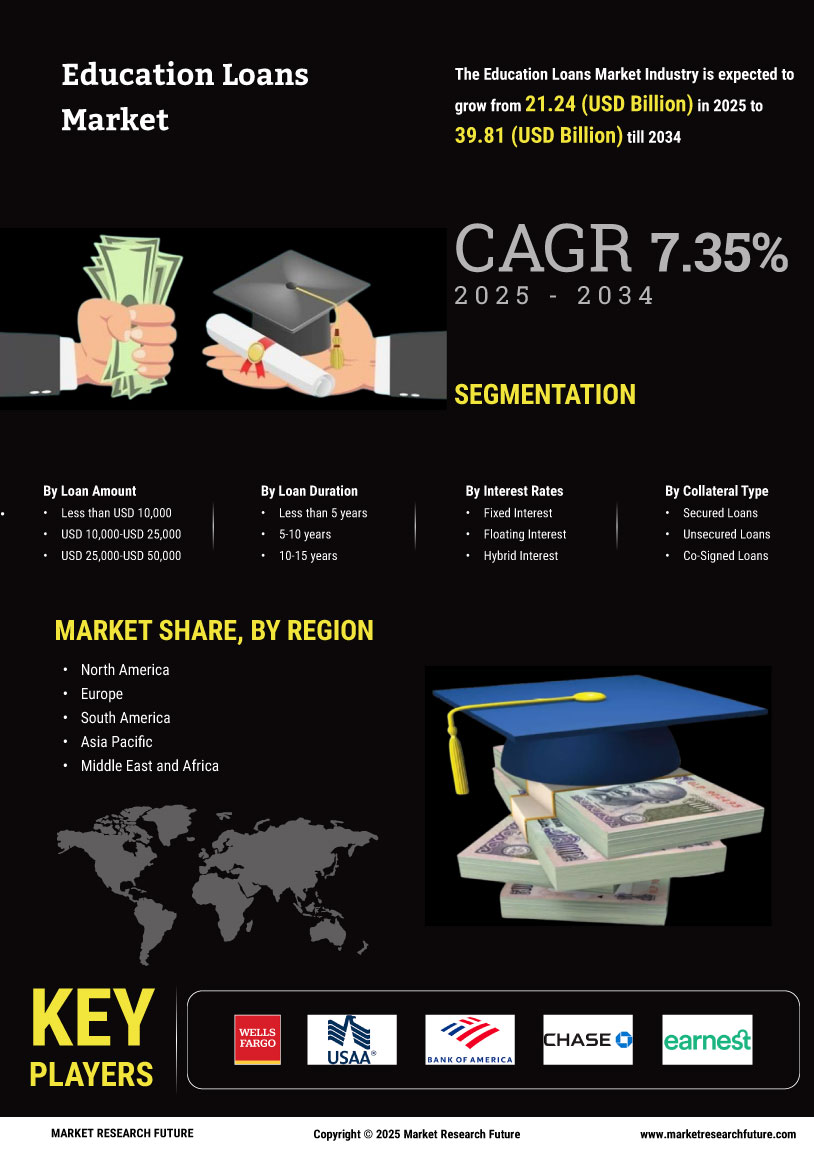

Growing Demand for Higher Education

The increasing demand for higher education is a primary driver of the Education Loans Market. As more individuals seek advanced degrees to enhance their career prospects, the need for financial assistance becomes paramount. According to recent data, enrollment in post-secondary institutions has risen steadily, with millions of students pursuing undergraduate and graduate programs. This trend indicates a robust market for education loans, as many students rely on loans to finance their education. The Education Loans Market is likely to expand as educational institutions continue to attract a diverse student population, including international students who often require substantial financial support. Furthermore, the rising costs of tuition and associated expenses further exacerbate the need for education loans, making this driver particularly influential in shaping market dynamics.

Diverse Demographics Seeking Education

The diverse demographics seeking education are reshaping the Education Loans Market. An increasing number of non-traditional students, including adult learners and working professionals, are pursuing further education to enhance their skills or change careers. This demographic shift is accompanied by a growing acceptance of online and part-time programs, which cater to the needs of these learners. Data suggests that the number of adult learners enrolling in higher education has increased, indicating a shift in the market landscape. As educational institutions adapt to these changing demographics, the demand for tailored loan products is likely to rise, further driving the growth of the Education Loans Market.

Rising Awareness of Financial Planning

The rising awareness of financial planning among students and parents is significantly influencing the Education Loans Market. As families become more informed about the costs associated with higher education, there is a growing emphasis on budgeting and financial literacy. This trend has led to an increase in proactive loan applications, as students seek to understand their financing options before enrolling in educational programs. Educational institutions are also responding by providing resources and workshops on financial management, further promoting the importance of planning for education expenses. Consequently, this heightened awareness is expected to drive demand for education loans, as more individuals recognize the necessity of financial support in achieving their academic goals.

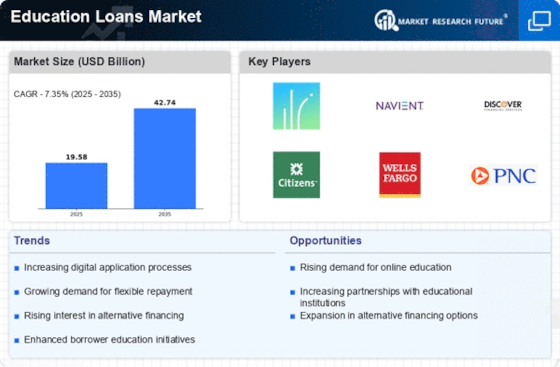

Technological Advancements in Loan Processing

Technological advancements are transforming the Education Loans Market by streamlining loan processing and enhancing customer experience. Innovations such as artificial intelligence and machine learning are being utilized to assess creditworthiness more efficiently, thereby expediting loan approvals. Data indicates that lenders are increasingly adopting digital platforms to facilitate online applications, which has led to a significant increase in loan disbursements. The integration of technology not only reduces operational costs for lenders but also provides borrowers with a more user-friendly experience. As technology continues to evolve, it is expected that the Education Loans Market will witness further growth, driven by the demand for faster and more accessible loan solutions.