Market Share

E Sports Market Share Analysis

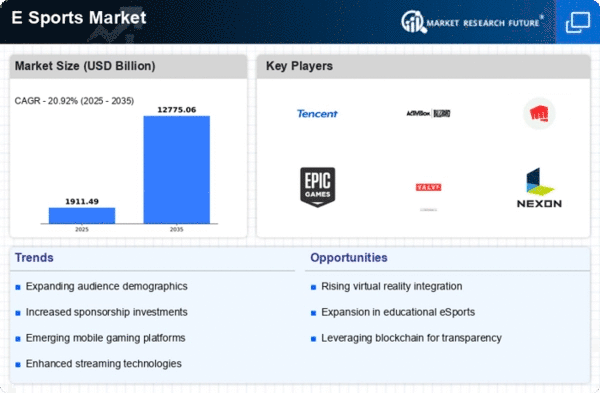

The Esports market is experiencing dynamic trends driven by the surging popularity of competitive gaming, technological advancements, and the increasing mainstream recognition of esports as a form of entertainment. One notable trend shaping this market is the continuous growth of esports viewership. Esports tournaments and leagues attract millions of viewers globally, both online and through traditional broadcasting platforms. Live streaming on Twitch and YouTube gaming has become a major change in the world of esports as now the fans get an opportunity to enjoy their favourite games and games experts in real time. This development, however, has caused esports to resemble the conventional sports, contests which many participate including fans who are sometimes referred to as enthusiasts, as well as sponsorship and advertising companies who seek to invest in esports.

The development of esports infrastructures will continue be central in Esports market, same focus on the creation of professional-grade gaming venues, training facilities and broadcasting studios. Esports companies along with many other stakeholders are now spending mechanized money on creating the best show venue to host tournaments, for providing upgraded facilities for professional players to rehearse and for improving the production quality of esports entertainment. Such condition of the infrastructure is not only increasing the expertise and authenticity of esports as a sport but likewise, it is attracting larger audiences and has been making traditional sports organizations invest massively in the same.

Games diversification in esports has a potential effect on the Market needs since it is one of the trends affecting the Esports market. While popular titles like League of Legends, Dota 2, and Counter-Strike: The popularity of multiplayer FPS games like Global Offensive also increase, which is the situation in the case of games belonging to new genres that are also gaining attention. Like Fortnite and Apex Legends that employ the battle royal genre or mobile esports games, the environment is being expanded and both a broader audience and the advertisers and sponsors that attracted them are being attracted to it. The varied options present them with resilience and adaptability at the same.

Another major breakthrough has been this trend of the arrival of large number of regional and absolutely franchise-based esports leagues which is similar to the traditional sports leagues. For example, organizations known as franchises, such as Overwatch League and Championship Series of League of Legends (LCS), have delocalized from the beginning, providing a local identity as well as strengthening the connection with their fans, by following their teams in their region.

A key trend in esports industry is a monetizing of the esports revenues which are directed through various revenue channels. Sports teams have been able to create earnings through sponsorships, advertisements, merchandise selling and other media rights agreements. Also, the rise of esports betting and there is also the feature for virtual in-game deals which are the new revenue sources.

The virtual and augmented reality (VR/AR) technology is nowadays common to have in esports. They introduce VR competitions and AR-enhanced broadcasts that are designed to engage both athletes and spectators in the process. From inexpensive cups to scientific instruments capable of detecting and analyzing pollutants, plastics have become a ubiquitous component of our daily lives.

The fact that giant – scale multi sport events that carry the status of Asian games and Olympics are welcoming e-sports is a sign that refers to the fact that e – sport profession has finally found a place in a world of serious sport. While discussions about esports' place in traditional sporting events continue, its inclusion in major tournaments underscores the industry's growth and acceptance on a global scale.

Leave a Comment