Regulatory Focus on Safety

The Duodenoscopes Market is significantly influenced by the heightened regulatory focus on patient safety. Regulatory bodies are implementing stringent guidelines to ensure the safety and efficacy of medical devices, particularly in the context of infection control. The introduction of new sterilization protocols and the requirement for rigorous testing of duodenoscopes are reshaping the market landscape. Recent statistics indicate that compliance with these regulations is becoming a critical factor for manufacturers aiming to maintain market access. As a result, companies are investing in research and development to meet these standards, which may lead to the introduction of safer and more effective duodenoscopes. This regulatory emphasis not only enhances patient safety but also fosters innovation within the Duodenoscopes Market, as manufacturers strive to align their products with evolving safety requirements.

Technological Advancements in Duodenoscopes

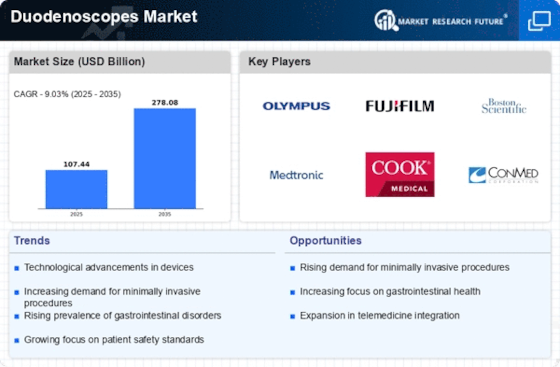

The Duodenoscopes Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as single-use duodenoscopes are emerging, which may potentially reduce the risk of infection associated with reusable devices. Furthermore, enhanced imaging technologies, including high-definition and narrow-band imaging, are being integrated into duodenoscopes, improving diagnostic accuracy. According to recent data, the market for advanced duodenoscopes is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years. This growth is driven by the increasing demand for minimally invasive procedures and the need for improved patient outcomes. As healthcare providers seek to adopt the latest technologies, the Duodenoscopes Market is likely to witness a surge in product development and innovation.

Rising Incidence of Gastrointestinal Disorders

The Duodenoscopes Market is witnessing growth driven by the rising incidence of gastrointestinal disorders. Conditions such as pancreatitis, biliary obstruction, and other digestive system ailments are becoming increasingly prevalent, necessitating the use of duodenoscopes for diagnosis and treatment. Recent epidemiological studies suggest that the global burden of gastrointestinal diseases is on the rise, with millions affected annually. This trend is likely to propel the demand for duodenoscopes, as healthcare providers seek effective solutions for managing these conditions. The increasing awareness of gastrointestinal health and the importance of early diagnosis further contribute to the market's expansion. As a result, the Duodenoscopes Market is expected to experience sustained growth, driven by the need for advanced diagnostic and therapeutic tools.

Growing Demand for Minimally Invasive Procedures

The Duodenoscopes Market is significantly impacted by the growing demand for minimally invasive procedures. Patients and healthcare providers alike are increasingly favoring techniques that reduce recovery time and minimize surgical risks. Duodenoscopes Market, known for their ability to facilitate non-surgical interventions, are becoming essential tools in this context. Market analysis indicates that the demand for minimally invasive gastrointestinal procedures is projected to increase, with a corresponding rise in the utilization of duodenoscopes. This trend is further supported by advancements in technology that enhance the capabilities of these devices, making them more effective and user-friendly. As the healthcare landscape evolves towards less invasive treatment options, the Duodenoscopes Market is likely to benefit from this shift, leading to increased adoption and market growth.

Increasing Investment in Healthcare Infrastructure

The Duodenoscopes Market is poised for growth due to increasing investment in healthcare infrastructure. Governments and private entities are allocating substantial resources to enhance healthcare facilities, particularly in developing regions. This investment is aimed at improving access to advanced medical technologies, including duodenoscopes, which are essential for effective gastrointestinal diagnostics and treatments. Recent reports indicate that healthcare spending is expected to rise significantly, with a focus on upgrading medical equipment and expanding healthcare services. As healthcare systems evolve and modernize, the demand for duodenoscopes is likely to increase, driven by the need for improved diagnostic capabilities. Consequently, the Duodenoscopes Market stands to gain from these infrastructural developments, as more facilities seek to incorporate advanced medical technologies into their offerings.