Rising Construction Activities

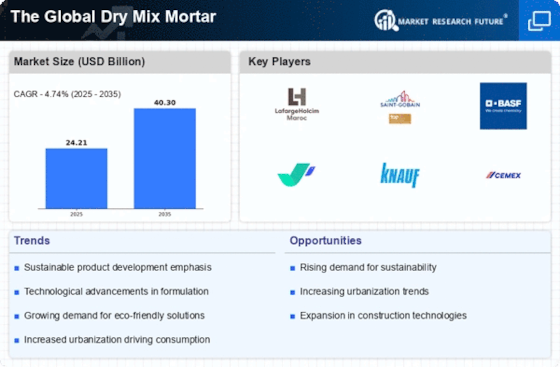

The increasing construction activities across various regions appear to be a primary driver for The Global Dry Mix Mortar Industry. As urbanization accelerates, the demand for residential, commercial, and industrial buildings rises significantly. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is likely to spur the need for efficient and high-quality construction materials, including dry mix mortar. The versatility and ease of application of dry mix mortar make it a preferred choice among contractors and builders, thereby enhancing its market presence. Furthermore, the trend towards prefabricated construction methods may also contribute to the increased adoption of dry mix mortar, as it aligns with the need for speed and efficiency in construction processes.

Increased Focus on Infrastructure Development

The Global Dry Mix Mortar Industry. Governments and private sectors are investing heavily in infrastructure projects, including roads, bridges, and public facilities, to support economic growth and improve living standards. Data indicates that infrastructure spending is expected to reach trillions of dollars in the coming years, creating a substantial demand for construction materials. Dry mix mortar, known for its efficiency and performance, is likely to play a vital role in these projects. The ability to provide quick-setting and durable solutions makes it an attractive option for large-scale infrastructure works. As such, the ongoing infrastructure initiatives are expected to bolster the market, providing opportunities for manufacturers to expand their product offerings.

Technological Innovations in Product Development

Technological advancements in the formulation and production of dry mix mortar are significantly shaping The Global Dry Mix Mortar Industry. Innovations such as the incorporation of advanced additives and polymers enhance the performance characteristics of dry mix mortars, including adhesion, flexibility, and durability. Recent studies indicate that the introduction of smart materials and self-healing technologies could revolutionize the market, potentially increasing the lifespan of structures. Furthermore, automation in manufacturing processes is likely to improve efficiency and reduce production costs, making dry mix mortars more accessible to a broader range of consumers. As these technologies continue to evolve, they may drive further growth in the market, attracting investments and fostering competition among manufacturers.

Growing Demand for Sustainable Building Materials

The heightened awareness regarding sustainability and environmental impact is influencing The Global Dry Mix Mortar Industry. As construction practices evolve, there is a marked shift towards eco-friendly materials that minimize carbon footprints. Dry mix mortars, often formulated with recycled materials and low-emission components, align well with these sustainability goals. Market data suggests that the demand for green building materials is expected to increase by over 10% annually, reflecting a broader trend in the construction industry. This shift not only meets regulatory requirements but also appeals to environmentally conscious consumers and builders. Consequently, manufacturers of dry mix mortar are likely to innovate and adapt their products to meet these emerging standards, thereby enhancing their competitive edge in the market.

Expansion of the Construction Industry in Emerging Markets

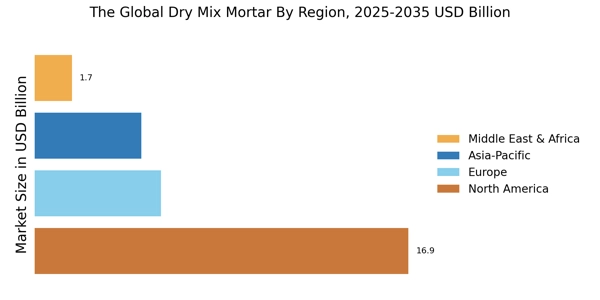

The expansion of the construction industry in emerging markets is poised to drive The Global Dry Mix Mortar Industry significantly. Countries in Asia-Pacific, Latin America, and parts of Africa are experiencing rapid urbanization and economic development, leading to increased construction activities. Market analysis suggests that these regions could witness a growth rate exceeding 7% in the construction sector over the next decade. This growth is likely to create a robust demand for dry mix mortar, as builders seek efficient and reliable materials to meet the needs of new developments. Additionally, the influx of foreign investments and the establishment of manufacturing facilities in these regions may further enhance the availability and affordability of dry mix mortar products, thereby stimulating market growth.