Cost Efficiency

The Global Drone Pipeline Inspection Market Industry is significantly driven by the cost efficiency associated with drone inspections. Traditional pipeline inspection methods often involve extensive labor and equipment costs, which can be prohibitive for many companies. In contrast, drones reduce the need for manual labor and minimize downtime, leading to substantial cost savings. For instance, utilizing drones can lower inspection costs by up to 50%, making it an attractive option for pipeline operators. This financial incentive encourages more companies to adopt drone technology, thereby fueling market growth and contributing to the projected increase in market size from 2.81 USD Billion in 2024 to 28.0 USD Billion by 2035.

Regulatory Compliance

Stringent regulatory requirements regarding pipeline safety and environmental protection are driving the Global Drone Pipeline Inspection Market Industry. Governments worldwide are increasingly mandating regular inspections to prevent leaks and ensure compliance with safety standards. For example, the U.S. Department of Transportation has established regulations that require pipeline operators to conduct routine inspections, which can be efficiently performed using drones. This regulatory landscape creates a robust demand for drone inspection services, as they offer a cost-effective and less intrusive alternative to traditional inspection methods. Consequently, the market is expected to witness a compound annual growth rate of 23.23% from 2025 to 2035.

Market Growth Projections

The Global Drone Pipeline Inspection Market Industry is poised for substantial growth, with projections indicating a rise from 2.81 USD Billion in 2024 to 28.0 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 23.23% from 2025 to 2035. Such figures reflect the increasing adoption of drone technology across various sectors, driven by factors such as technological advancements, regulatory compliance, and cost efficiency. The market's expansion is indicative of a broader trend towards automation and innovation in pipeline inspection processes, positioning drones as a critical component of future infrastructure management.

Technological Advancements

The Global Drone Pipeline Inspection Market Industry is experiencing rapid technological advancements that enhance inspection capabilities. Innovations such as high-resolution cameras, thermal imaging, and LiDAR technology significantly improve the accuracy and efficiency of pipeline inspections. These advancements allow for real-time data collection and analysis, reducing the time required for inspections. For instance, drones equipped with these technologies can identify potential leaks or structural weaknesses in pipelines more effectively than traditional methods. As a result, the market is projected to grow from 2.81 USD Billion in 2024 to 28.0 USD Billion by 2035, reflecting a growing reliance on advanced drone technologies.

Environmental Sustainability

Growing concerns regarding environmental sustainability are influencing the Global Drone Pipeline Inspection Market Industry. Drones offer a less invasive method for inspecting pipelines, which minimizes environmental disruption compared to traditional inspection techniques. This aligns with the increasing emphasis on sustainable practices within the energy sector. Companies are increasingly adopting drone technology to demonstrate their commitment to environmental stewardship while ensuring compliance with regulations. As a result, the market is likely to benefit from this shift towards sustainability, as more organizations recognize the advantages of using drones for environmentally friendly inspections.

Increased Demand for Infrastructure Monitoring

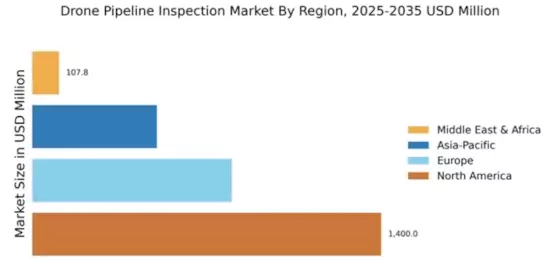

The Global Drone Pipeline Inspection Market Industry is witnessing increased demand for infrastructure monitoring due to aging pipeline networks and the need for regular maintenance. As pipelines age, the likelihood of leaks and failures rises, necessitating frequent inspections to ensure safety and reliability. Drones provide an efficient solution for monitoring these infrastructures, allowing for comprehensive assessments without disrupting operations. This demand is particularly pronounced in regions with extensive pipeline networks, such as North America and Europe. As the need for proactive maintenance grows, the market is expected to expand significantly, aligning with the overall trend of infrastructure investment.