Top Industry Leaders in the Double Diaphragm Pumps Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Double Diaphragm Pumps industry are:

IDEX Corporation (US), Yamada Corporation (Japan), Flowserve Corporation (US), Ingersoll Rand (Ireland), Grundfos Holding A/S (Denmark), Xylem, Inc. (US), SPX Flow (US), Pump Solutions Group (US), Metex Corporation (Canada), Global Pumps (US), Graco, Inc., (US), All-Flo Pump Co. (US), AxFlow Holding AB (Sweden), Fluimac S.r.l. (Italy), and CDR Pumps Ltd (UK)

Bridging the Gap by Exploring the Competitive Landscape of the Double Diaphragm Pumps Top Players

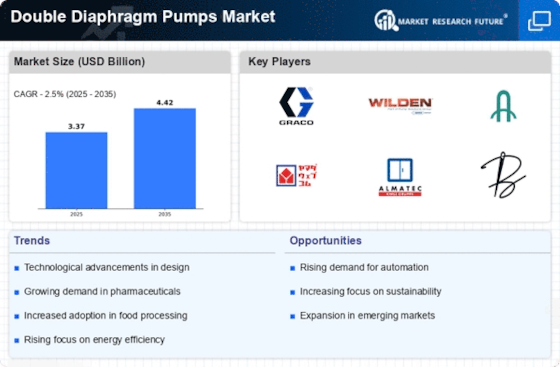

The double diaphragm pump market is a dynamic space defined by robust growth and fierce competition. Driven by factors like increasing investments in water treatment, chemical processing, and pharmaceutical industries. Navigating this landscape requires a keen understanding of the key players, their strategies, and the emerging trends shaping the future.

Key Players and their Strategies:

- Global Giants: Established players like IDEX Corporation, Yamada Corporation, Flowserve Corporation, and Ingersoll Rand dominate the market with their diversified product portfolios, strong brand recognition, and extensive global distribution networks. Their strategies focus on continuous product innovation, strategic acquisitions, and expanding into high-growth regional markets. For instance, IDEX's recent acquisition of Wilden further bolstered its position in the air-operated double diaphragm pump segment.

- Regional Leaders: Regional players like SPX Flow, Grundfos, and Xylem are carving out significant niches with their cost-effective offerings and focus on specific applications. Grundfos, for example, has gained traction in the water treatment sector with its energy-efficient diaphragm pumps.

- Niche Players: Smaller, niche players like All-Flo Pump Co. and Fluimac S.r.l. are finding success by specializing in customized solutions for unique applications. Their agility and focus on specific end-user segments allow them to compete effectively against larger players.

Factors for Market Share Analysis:

- Product Portfolio: The breadth and depth of a company's product offerings play a crucial role in market share. Players with wider ranges catering to diverse pressure, material, and application needs hold an advantage.

- Geographical Presence: A strong global presence, particularly in high-growth regions like Asia Pacific, significantly impacts market share. Players with established distribution networks and local manufacturing capabilities are better positioned to capitalize on regional opportunities.

- Technological Innovation: Continuous investment in research and development to improve pump efficiency, material robustness, and automation features is crucial for differentiation and market share gains. Companies like Yamada with their focus on diaphragm material advancements are leading the way.

- Pricing Strategy: Pricing strategies vary across players, with some focusing on premium offerings and others on cost-competitiveness. Understanding the target customer segment and value proposition is key to determining an effective pricing strategy.

- After-sales Service: Providing reliable and prompt after-sales service, including spare parts availability and maintenance support, builds customer loyalty and repeat business, ultimately impacting market share.

New and Emerging Trends:

- Sustainable Materials: Growing environmental concerns are driving demand for pumps made from sustainable and recyclable materials like bioplastics. Players like All-Flo are actively incorporating these materials into their products.

- Digitalization and Automation: Integration of intelligent sensors, data analytics, and remote monitoring capabilities is transforming pump operation and maintenance. Companies like Xylem are at the forefront of this trend with their smart pump solutions.

- Focus on Energy Efficiency: Rising energy costs necessitate pumps with optimized performance and minimal energy consumption. Players like Grundfos are developing energy-efficient pumps with variable speed drives and advanced control systems.

- Customization and Niche Applications: The market is witnessing a growing demand for customized pumps for specific applications in industries like food and beverage, pharmaceuticals, and biotechnology. Players with strong engineering expertise and the ability to cater to these niche needs are well-positioned to capitalize on this trend.

Overall Competitive Scenario:

The double diaphragm pump market is characterized by intense competition, with players vying for market share through a combination of strategies. While established players leverage their brand recognition and global reach, regional and niche players are finding success through specialization and cost-effectiveness. The market is also witnessing a shift towards sustainable materials, digitalization, and energy efficiency, presenting both challenges and opportunities for players. Success in this dynamic landscape will depend on a company's ability to adapt to these evolving trends, innovate continuously, and cater to the specific needs of diverse customer segments.

This analysis provides a snapshot of the competitive landscape in the double diaphragm pump market. By understanding the key players, their strategies, and the emerging trends, companies can make informed decisions to gain a competitive edge and navigate the path to future success.

Latest Company Updates:

IDEX Corporation: Acquired Wilden Pump & Motor in October 2023, expanding its portfolio of air-operated diaphragm pumps. (Source: IDEX press release, Oct 26, 2023)

Yamada Corporation: Launched the YDP series of electric diaphragm pumps in Europe, targeting the food and beverage industry. (Source: Yamada Europe press release, Dec 5, 2023)

Flowserve Corporation: Partnered with a research institute to develop new diaphragm materials for high-temperature applications. (Source: Flowserve Investor Presentation, Nov 9, 2023)

Ingersoll Rand: Released a white paper on the benefits of using double diaphragm pumps for hazardous fluid transfer. (Source: Ingersoll Rand website, Jan 10, 2024)

Grundfos Holding A/S: Received an order for large-scale diaphragm pumps for a wastewater treatment plant in China. (Source: Grundfos newsroom, Jan 12, 2024)