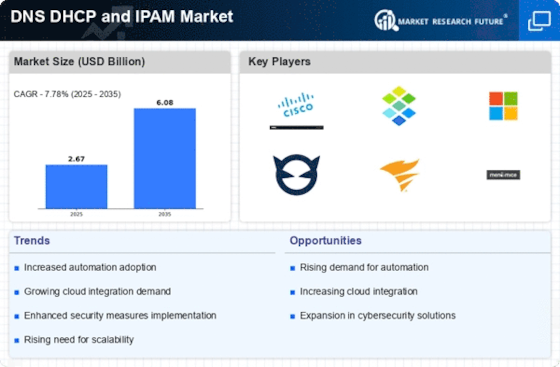

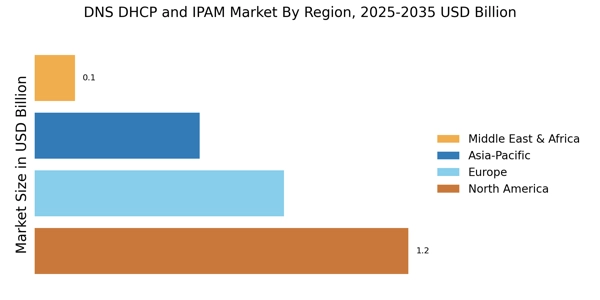

North America : Innovation and Leadership Hub

North America is the largest market for DNS, DHCP, and IPAM solutions, holding approximately 45% of the global market share. The region's growth is driven by the increasing demand for cloud-based services, cybersecurity measures, and the proliferation of IoT devices. Regulatory frameworks, such as the Federal Information Security Management Act (FISMA), further catalyze market expansion by mandating robust network management solutions.

The competitive landscape is characterized by major players like Cisco Systems, Microsoft, and Infoblox, which dominate the market with innovative solutions. The U.S. leads in adoption rates, followed by Canada, which is also witnessing significant growth due to its expanding tech sector. The presence of these key players ensures a dynamic market environment, fostering continuous advancements in DNS, DHCP, and IPAM technologies.

Europe : Regulatory-Driven Market Growth

Europe is the second-largest market for DNS, DHCP, and IPAM solutions, accounting for approximately 30% of the global market share. The region's growth is propelled by stringent data protection regulations like the General Data Protection Regulation (GDPR), which necessitate advanced network management solutions. Additionally, the increasing adoption of cloud services and digital transformation initiatives across various sectors are significant demand drivers.

Leading countries in this region include Germany, the UK, and France, where the presence of key players such as Men & Mice and F5 Networks is notable. The competitive landscape is evolving, with a focus on compliance and security, making it imperative for organizations to invest in robust DNS, DHCP, and IPAM solutions to meet regulatory requirements. This trend is expected to continue as businesses prioritize data security and operational efficiency.

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific is witnessing rapid growth in the DNS, DHCP, and IPAM market, holding approximately 20% of the global market share. The region's expansion is driven by increasing internet penetration, the rise of smart cities, and a growing emphasis on cybersecurity. Countries like China and India are leading this growth, supported by government initiatives aimed at enhancing digital infrastructure and connectivity.

The competitive landscape features key players such as BlueCat Networks and SolarWinds, which are capitalizing on the region's demand for innovative solutions. The presence of a burgeoning tech ecosystem, coupled with investments in IT infrastructure, is fostering a favorable environment for DNS, DHCP, and IPAM solutions. As organizations in this region continue to embrace digital transformation, the market is expected to expand significantly in the coming years.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region is emerging as a potential market for DNS, DHCP, and IPAM solutions, currently holding about 5% of the global market share. The growth is driven by increasing internet adoption, the rise of mobile connectivity, and government initiatives aimed at enhancing digital infrastructure. Countries like the UAE and South Africa are at the forefront, with investments in smart technologies and cybersecurity measures acting as catalysts for market growth.

The competitive landscape is still developing, with local and international players vying for market share. Companies are focusing on tailored solutions to meet the unique needs of the region, which is characterized by diverse regulatory environments and varying levels of technological adoption. As the region continues to invest in digital transformation, the demand for DNS, DHCP, and IPAM solutions is expected to rise significantly.