Top Industry Leaders in the Distribution Feeder Protection System Market

*Disclaimer: List of key companies in no particular order

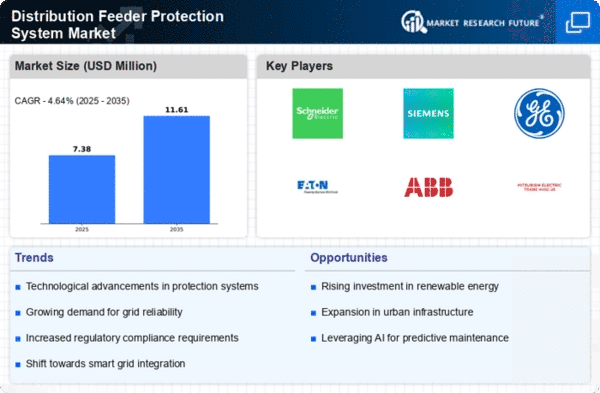

Top listed global companies in the Distribution Feeder Protection System industry are:

ABB (Switzerland), Siemens AG (Germany), General Electric (US), Eaton Co. Plc. (Ireland), Schneider Electric SA (France), Crompton Greaves Ltd. (India), Toshiba Corporation (Japan), Basler Electric Company. (US), Mitsubishi Electric Corporation (Japan), Schweitzer Engineering Laboratories, Inc. (US), Littelfuse Inc. (US), and Fanox Electronic, S.L. (Spain), Larsen & Toubro (India), Western Power Distribution (UK), and NOJA Power (Australia)

Bridging the Gap by Exploring the Competitive Landscape of the Distribution Feeder Protection System Top Players

The distribution feeder protection system market is experiencing a dynamic shift, driven by factors like grid modernization, renewable energy integration, and technological advancements. In this evolving landscape, understanding the competitive strategies of key players and emerging trends is crucial for success.

Major players:

Global giants: ABB, Siemens, Schneider Electric, Eaton, and General Electric dominate the market with their established portfolios, comprehensive solutions, and strong brand recognition. Their strategies rely on continuous product innovation, strategic partnerships, and geographical expansion.

Regional players: Companies like NOJA Power Switchgear (Australia), Fanox (China), and Crompton Greaves (India) are carving niches in regional markets with cost-effective solutions and customized offerings. They often focus on specific applications or integrate local knowledge to differentiate themselves.

Technology disruptors: Emerging players like Schweitzer Engineering Laboratories and NGRAIN are entering the market with innovative solutions focused on advanced functionalities like cybersecurity, real-time monitoring, and data analytics. These companies leverage agile development, cloud-based platforms, and AI-powered algorithms to challenge established players.

Key player strategies:

Product diversification: Major players are expanding their product offerings beyond traditional protection relays to include communication infrastructure, automation software, and data management solutions. This comprehensive approach aims to address the growing demand for integrated feeder protection systems.

Technological advancements: Research and development efforts are focused on integrating next-generation technologies like artificial intelligence, big data analytics, and the Internet of Things (IoT) into feeder protection systems. This enables predictive maintenance, self-healing grids, and improved decision-making capabilities.

Strategic partnerships: Collaborations with utilities, grid operators, and technology providers are becoming increasingly common. These partnerships facilitate knowledge sharing, joint product development, and faster market penetration.

Regional expansion: Established players are targeting emerging markets with high growth potential like Asia-Pacific and Latin America. Regional players, on the other hand, are looking to expand their global footprint by leveraging partnerships and strategic acquisitions.

Factors for market share analysis:

Product portfolio breadth and depth: Offering a variety of solutions catered to diverse needs and budgets gives players an edge.

Technological capabilities: Advanced functionalities like fault location, automation, and cybersecurity integration add value and attract customers.

Reliability and performance: A proven track record of reliable operation and effective fault protection is crucial for building trust and gaining market share.

Brand reputation and customer support: Established brands and players with strong customer support channels have a clear advantage.

Cost-competitiveness: Maintaining competitive pricing without compromising quality is essential, especially in price-sensitive markets.

Emerging trends:

Cloud-based solutions: Offering cloud-based software and data management platforms is gaining traction for remote monitoring, system optimization, and predictive maintenance.

Microgrids and distributed generation: Increased integration of microgrids and distributed renewable energy sources necessitates flexible and intelligent feeder protection systems.

Cybersecurity: Growing concerns about cyberattacks on critical infrastructure are driving demand for secure and resilient protection systems.

Standardization and interoperability: Efforts are underway to establish global standards for communication protocols and data formats to ensure seamless integration of different vendors' equipment.

Overall competitive scenario:

The distribution feeder protection system market is witnessing intense competition between established players, regional players, and technology disruptors. While technological advancements and emerging trends create exciting opportunities, competition is likely to remain fierce. Success will depend on a combination of factors, including strong product portfolios, continuous innovation, strategic partnerships, and a deep understanding of evolving customer needs.

Latest Company Updates:

ABB (Switzerland):

- July 2023: Launched the Relion® REX620 protection relay specifically designed for distribution feeders, offering advanced protection features and communication capabilities. (Source: ABB press release)

Siemens AG (Germany):

- September 2023: Introduced the SIPROTEC 4700 relay series with advanced fault detection and clearing capabilities for improved distribution feeder protection. (Source: Siemens press release)

General Electric (US):

- April 2023: Acquired Itron, a leading provider of smart grid solutions, including distribution automation technologies for feeder protection. (Source: GE press release)

Eaton Co. Plc. (Ireland):

- June 2023: Released the IntelliRupter® recloser with advanced fault location and communication features for enhanced distribution feeder protection and grid reliability. (Source: Eaton website)

Schneider Electric SA (France):

- March 2023: Launched the Easergy Microgrid Manager, a comprehensive solution for microgrid management, including protection and control of distribution feeders. (Source: Schneider Electric website)