Top Industry Leaders in the Distribution Feeder Automation System Market

*Disclaimer: List of key companies in no particular order

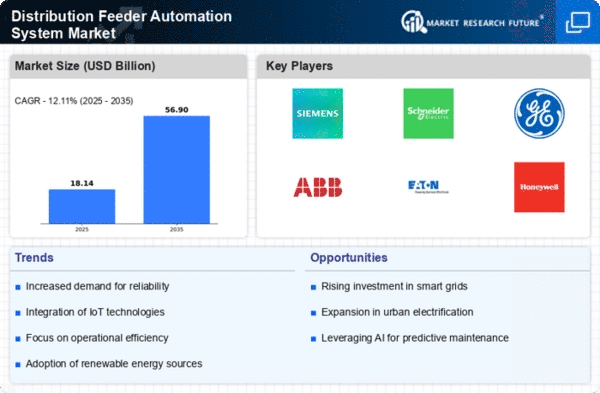

Top listed global companies in the Distribution Feeder Automation System industry are:

ABB (Switzerland), Schneider Electric (France), Siemens (Germany), G&W Electric (US), Schweitzer Engineering Laboratories Inc (US), Eaton (Ireland), Advanced Control Systems Inc (US), Cisco (US), Moxa Inc (Taiwan), Crompton Greaves Ltd (India), and General Electric (US).

Bridging the Gap by Exploring the Competitive Landscape of the Distribution Feeder Automation System Top Players

The Distribution Feeder Automation System (DFAS) market has become increasingly dynamic in recent years, driven by the burgeoning adoption of smart grid technologies. Navigating this landscape requires a detailed understanding of the key players, their strategies, and the emerging trends shaping the market.

Major Players and Strategies:

Global Giants: Siemens, ABB, Schneider Electric, GE Grid Solutions, Eaton, and Mitsubishi Electric dominate the market with their established product portfolios, robust R&D capabilities, and extensive global reach. These players focus on offering comprehensive DFAS solutions encompassing hardware, software, and services, along with partnerships with utilities and technology providers.

Regional Players: Companies like Elster Group (Honeywell), Schweitzer Engineering Laboratories, and ZIV have carved a niche in specific segments or regions. While some excel in hardware like reclosers and fault circuit indicators, others focus on software solutions for monitoring and control. These players leverage their understanding of local regulations and market nuances to compete effectively.

Emerging Players: Start-ups like GridBeyond, Gridsmart, and Enbala are bringing innovative solutions to the market, often specializing in areas like microgrid management, data analytics, and edge computing. They challenge established players through agility, flexibility, and cost-effective offerings.

Factors for Market Share Analysis:

Product Portfolio: Breadth and depth of hardware offerings (reclosers, switches, sensors), software capabilities (topology management, fault detection, optimization algorithms), and service expertise (consulting, deployment, maintenance) influence market share.

Geographical Presence: A strong footprint in key regions like North America, Europe, and Asia-Pacific with established distribution channels and customer relationships provides an edge.

Technological Prowess: Continuous investment in R&D, integration of advanced technologies like IoT and AI, and development of future-proof solutions are crucial for long-term success.

Collaboration and Partnerships: Collaborations with utilities, technology providers, and research institutions expand reach, enhance expertise, and facilitate faster innovation.

New and Emerging Trends:

Software Dominance: The market is shifting towards software-driven solutions, with intelligent algorithms playing a vital role in optimizing feeder operation, minimizing power losses, and predicting faults.

Cloud-based Deployment: Cloud-based solutions offer cost-efficiency, scalability, and real-time data access, driving their adoption amongst utilities.

Cybersecurity Focus: With growing reliance on digital technologies, robust cybersecurity measures and threat mitigation strategies are becoming paramount.

Integration with Renewables: DFAS is increasingly integrated with renewable energy sources like solar and wind, enabling optimal grid management and grid stability.

Overall Competitive Scenario:

The DFAS market is characterized by intense competition with players vying for market share through continuous innovation, strategic partnerships, and regional expansion. While established players leverage their brand recognition and comprehensive solutions, smaller players and start-ups are disrupting the market with niche offerings and agile approaches. The focus on software, cloud-based solutions, and integration with renewables are expected to reshape the competitive landscape in the coming years.

To remain successful in this dynamic market, players must:

Develop a clear understanding of evolving customer needs and regional regulations.

Invest in R&D to stay ahead of the technological curve.

Embrace collaborative partnerships and leverage the expertise of different stakeholders.

Prioritize cybersecurity and data privacy to build trust with utilities.

Offer flexible and scalable solutions adaptable to diverse grid landscapes.

By navigating these critical factors and adapting to the changing market landscape, DFAS players can secure a strong position in this rapidly growing and strategically important market.

This analysis provides a comprehensive overview of the competitive landscape in the DFAS market. However, it is crucial to stay updated on the latest developments, player strategies, and emerging trends for effective navigation in this dynamic space.

Latest Company Updates:

ABB:

- Launched the MicroSCADA Pro V14.0 automation platform with enhanced support for DFAS applications (October 26, 2023, ABB Press Release).

Schneider Electric:

- Unveiled the EcoStruxure MicroGrid Advisor solution for advanced grid management and optimization, including DFAS capabilities (September 20, 2023, Schneider Electric website).

Siemens:

- Introduced the SENTRON PAC 4200 controller specifically designed for DFAS applications with advanced communication features (May 11, 2023, Siemens Website).

G&W Electric:

- Announced the launch of the iVAC® Feeder Automation System with advanced fault detection and isolation capabilities (September 13, 2023, G&W Electric Press Release).