Distributed Edge Cloud Market Summary

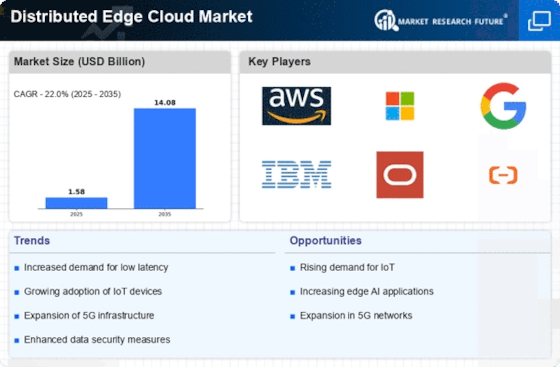

As per Market Research Future analysis, the Distributed Edge Cloud Market Size was estimated at 1.58 USD Billion in 2024. The Distributed Edge Cloud industry is projected to grow from 1.928 USD Billion in 2025 to 14.08 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 22.0% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Distributed Edge Cloud Market is poised for substantial growth driven by technological advancements and evolving consumer demands.

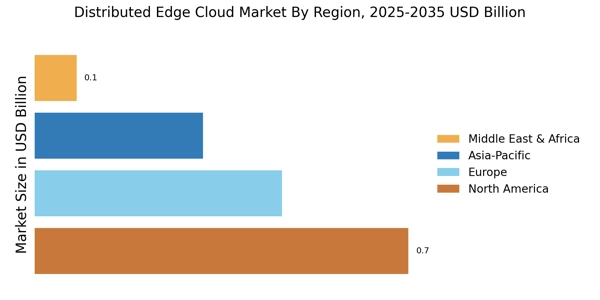

- North America remains the largest market for distributed edge cloud solutions, driven by robust infrastructure and technological innovation.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid urbanization and increasing investments in digital transformation.

- Data security is the largest segment, as organizations prioritize safeguarding sensitive information in an increasingly connected world.

- Key market drivers include the rising demand for low latency applications and the expansion of 5G networks, which are essential for enhancing edge computing capabilities.

Market Size & Forecast

| 2024 Market Size | 1.58 (USD Billion) |

| 2035 Market Size | 14.08 (USD Billion) |

| CAGR (2025 - 2035) | 22.0% |

Major Players

Amazon Web Services (US), Microsoft (US), Google (US), IBM (US), Oracle (US), Alibaba Cloud (CN), Hewlett Packard Enterprise (US), Dell Technologies (US), EdgeConneX (US)