Growth in Consumer Electronics

The Display Controller Market is significantly influenced by the growth in consumer electronics, particularly in the television and smartphone segments. As consumers increasingly prioritize high-quality visual experiences, manufacturers are investing in advanced display technologies that require sophisticated display controllers. The market for consumer electronics is projected to exceed 1 trillion dollars by 2025, with a substantial portion attributed to display technologies. This growth is likely to drive demand for innovative display controllers that can support features such as high dynamic range and enhanced color accuracy. Consequently, manufacturers are presented with opportunities to develop cutting-edge solutions that meet the evolving expectations of consumers.

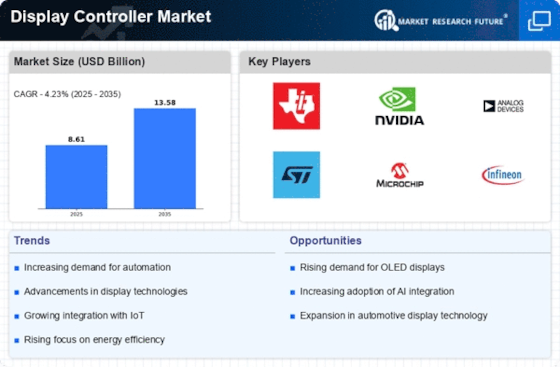

Advancements in Display Technologies

The Display Controller Market is poised for growth due to ongoing advancements in display technologies, including OLED, MicroLED, and MiniLED. These technologies offer superior image quality and energy efficiency, prompting manufacturers to develop compatible display controllers. As the market for these advanced displays expands, the demand for innovative display controllers that can effectively manage their unique characteristics is likely to increase. Recent projections indicate that the OLED display market alone could surpass 50 billion dollars by 2026. This trend underscores the necessity for display controller manufacturers to adapt and innovate, ensuring their products align with the latest technological advancements in the display sector.

Expansion of Automotive Display Systems

The automotive sector is witnessing a transformative shift towards advanced display systems, significantly impacting the Display Controller Market. With the rise of electric and autonomous vehicles, the integration of sophisticated infotainment systems and digital dashboards is becoming commonplace. Display controllers play a crucial role in managing these complex systems, ensuring seamless interaction between the driver and the vehicle's technology. Recent statistics suggest that the automotive display market is expected to reach a valuation of over 30 billion dollars by 2026, highlighting the potential for growth in the display controller segment. This expansion presents opportunities for manufacturers to develop specialized controllers tailored for automotive applications.

Emergence of Virtual and Augmented Reality

The rise of virtual reality (VR) and augmented reality (AR) technologies is reshaping the Display Controller Market. These immersive technologies demand high-performance display controllers capable of delivering smooth and responsive visuals. As industries such as gaming, education, and healthcare increasingly adopt VR and AR solutions, the need for advanced display controllers becomes paramount. Market analysis indicates that the VR and AR market is expected to grow exponentially, potentially reaching over 200 billion dollars by 2025. This growth trajectory suggests a significant opportunity for display controller manufacturers to innovate and provide solutions that enhance the user experience in these emerging applications.

Increasing Demand for High-Resolution Displays

The Display Controller Market is experiencing a surge in demand for high-resolution displays, driven by advancements in display technologies. As consumers increasingly seek superior visual experiences, manufacturers are compelled to enhance their offerings. The proliferation of 4K and 8K displays across various sectors, including consumer electronics and professional applications, necessitates sophisticated display controllers capable of managing higher pixel densities. According to recent data, the market for high-resolution displays is projected to grow at a compound annual growth rate of over 15% through the next few years. This trend indicates a robust opportunity for display controller manufacturers to innovate and cater to the evolving needs of consumers and businesses alike.