Top Industry Leaders in the Directional Drilling Market

*Disclaimer: List of key companies in no particular order

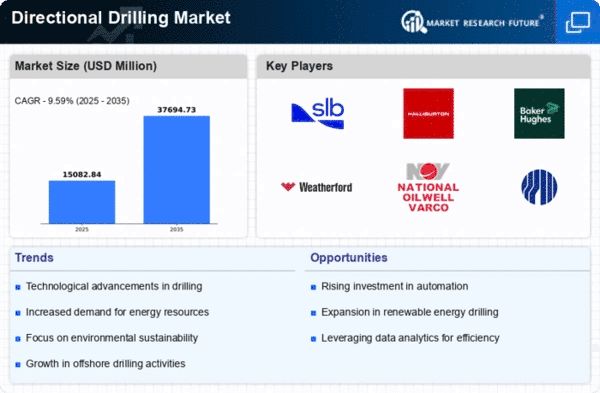

The directional drilling market, an integral component of the energy exploration and production sector, represents a maze filled with established industry leaders, emerging contenders, and a continuous influx of technological advancements. To successfully navigate this ever-evolving landscape, a comprehensive understanding of the competitive dynamics becomes paramount. This analysis delves into the strategies implemented by key players, the factors influencing market share, emerging trends, and the overarching competitive scenario.

Industry Key Players:

- Baker Hughes Incorporated (U.S.)

- National Oilwell Varco (U.S.)

- Weatherford International Plc. (U.S.)

- Schlumberger Ltd (U.S.)

- Halliburton Company (U.S.)

- Nabors Industries Ltd (Bermuda)

- Cathedral Energy Services Ltd (Canada)

- Gyrodata Incorporated (U.S.)

Global Giants and Niche Experts: The directional drilling market features a blend of global service providers such as Schlumberger, Halliburton, and Baker Hughes, holding substantial market share due to their extensive track records, global reach, and technological prowess. Concurrently, smaller, regionally focused players like Weatherford International and National Oilwell Varco (NOV) have carved out niches by capitalizing on local expertise and cost-effectiveness. These entities focus on specific geographic sectors or provide specialized services, establishing themselves as formidable competitors in their respective domains.

Strategy Playbook: Diversification and Innovation: Acknowledging the need for diversification beyond traditional oil and gas exploration, leading players are actively pursuing opportunities in geothermal energy, carbon capture and storage (CCS), and infrastructure development. They leverage their directional drilling expertise to tap into these emerging markets. Technological innovation stands as another critical differentiator, with investments flowing into automation, robotics, and real-time data analytics, consistently pushing the boundaries of operational efficiency and accuracy.

Market Share Mosaic: A Multifaceted Picture: Market share in the directional drilling realm is a complex tapestry woven from various threads. Elements like geographical presence, service portfolio, technological capabilities, cost competitiveness, and client relationships all play significant roles. Additionally, specific application parameters (onshore vs. offshore), well depth, and formation complexity influence project selection and, consequently, market share distribution.

Emerging Trends: Redefining the Future: Several emerging trends are reshaping the directional drilling landscape. The rise of automated drilling systems, reducing human intervention and minimizing operational risks, stands as a key trend. The integration of artificial intelligence (AI) and machine learning is facilitating real-time wellbore optimization and improved decision-making. Moreover, the focus on environmentally friendly drilling practices gains traction, with advancements in mudlogging and waste management technologies paving the way for sustainable operations.

Competitive Scenario: A Dynamic Equilibrium: The competitive landscape is characterized by dynamic equilibrium, where consolidation through mergers and acquisitions remains a possibility, and technological disruption can upset the established order. Smaller players with innovative solutions can swiftly gain traction, compelling larger companies to adapt or risk losing market share. Collaboration between competitors in specific projects or technology development is becoming increasingly common, leveraging each other's strengths for mutual benefit.

Looking Ahead: A Maze with Multiple Exits: The future of the directional drilling market presents both promise and challenge. The growing demand for energy, coupled with the depletion of readily accessible reserves, will sustain the need for directional drilling technology. However, fluctuations in oil and gas prices, environmental concerns, and the emergence of alternative energy sources will require market players to remain adaptable and agile. Those successfully navigating this complex landscape, embracing innovation, and forging strategic partnerships will chart the course towards a successful future.

Company Updates:

-

Baker Hughes (BHI):- Announced a partnership with Chevron to develop next-generation drilling technologies for improved wellbore placement and reservoir access. (Source: BHI press release, December 12, 2023)

-

National Oilwell Varco (NOV):- Secured a multi-million dollar contract to supply drilling rigs and directional drilling equipment for a major LNG project in Qatar. (Source: NOV press release, November 7, 2023)

-

Weatherford International (WFT):- Successfully completed the world's first extended-reach well deployment using its next-generation rotary steerable system in the North Sea. (Source: WFT press release, September 29, 2023)

-

Schlumberger (SLB):- Introduced a new AI-powered drilling platform that automates critical directional drilling tasks, improving wellbore accuracy and reducing operational costs. (Source: SLB press release, December 8, 2023)