Technological Advancements

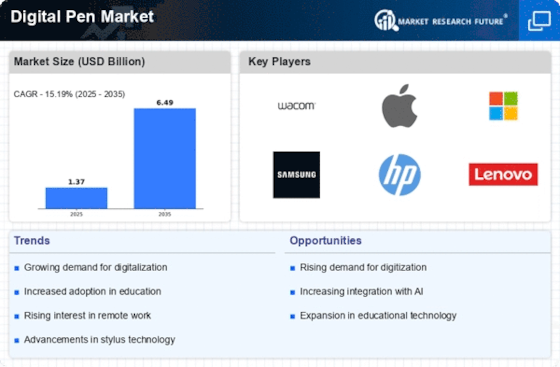

The Digital Pen Market is experiencing a surge in demand due to rapid technological advancements. Innovations in sensor technology and Bluetooth connectivity have enhanced the functionality of digital pens, making them more appealing to consumers. For instance, the integration of pressure sensitivity and tilt recognition allows for a more natural writing experience, akin to traditional pen and paper. According to recent data, the market for digital pens is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the increasing adoption of digital note-taking solutions in educational institutions and corporate environments, where efficiency and organization are paramount. As technology continues to evolve, the Digital Pen Market is likely to see further enhancements that could redefine user experiences.

Integration with Smart Devices

The Digital Pen Market is significantly impacted by the integration of digital pens with smart devices. As smartphones, tablets, and laptops become ubiquitous, the ability to connect digital pens to these devices enhances their functionality and appeal. This integration allows users to easily transfer handwritten notes to digital formats, facilitating better organization and accessibility. Market analysis indicates that the compatibility of digital pens with popular operating systems and applications is a crucial factor influencing consumer choices. Furthermore, the rise of smart home technology and the Internet of Things (IoT) is likely to create new opportunities for digital pen manufacturers. As users increasingly seek cohesive ecosystems of devices, the Digital Pen Market may experience growth driven by innovations that enhance connectivity and user experience.

Consumer Preference for Portability

The Digital Pen Market is influenced by a growing consumer preference for portable and versatile writing instruments. As lifestyles become increasingly mobile, consumers are seeking tools that can easily transition between different environments, such as home, office, and on-the-go. Digital pens that are lightweight, compact, and equipped with long battery life are particularly appealing to users who value convenience. Recent surveys indicate that nearly 60% of consumers prioritize portability when selecting digital writing tools. This trend is driving manufacturers to innovate and design products that cater to this demand, resulting in a wider variety of options in the Digital Pen Market. As portability continues to be a key factor in consumer decision-making, the market is likely to see sustained growth in this segment.

Rising Demand for Digital Learning Tools

The Digital Pen Market is witnessing a notable increase in demand for digital learning tools, particularly in educational settings. As educational institutions increasingly adopt digital platforms for teaching and learning, the need for effective note-taking solutions has become more pronounced. Digital pens facilitate seamless integration with tablets and smart devices, allowing students to capture and organize information efficiently. Recent statistics indicate that the education sector accounts for a significant portion of digital pen sales, with projections suggesting that this segment could represent over 40% of the market by 2026. This trend reflects a broader shift towards digitalization in education, where tools that enhance learning experiences are highly sought after. Consequently, the Digital Pen Market is positioned to benefit from this growing emphasis on digital learning.

Increased Adoption in Professional Settings

The Digital Pen Market is also experiencing increased adoption in professional settings, particularly among creative and design professionals. The ability to create digital sketches, annotations, and designs with precision has made digital pens indispensable tools in fields such as architecture, graphic design, and engineering. Market data suggests that the professional segment is expected to grow significantly, driven by the need for efficient workflows and collaboration. As remote work becomes more prevalent, professionals are seeking tools that enhance productivity and creativity. Digital pens offer features such as cloud synchronization and compatibility with various software applications, making them attractive to users in these sectors. This trend indicates that the Digital Pen Market is likely to expand as more professionals recognize the value of integrating digital pens into their daily tasks.