Market Trends

Key Emerging Trends in the Digital Evidence Management Market

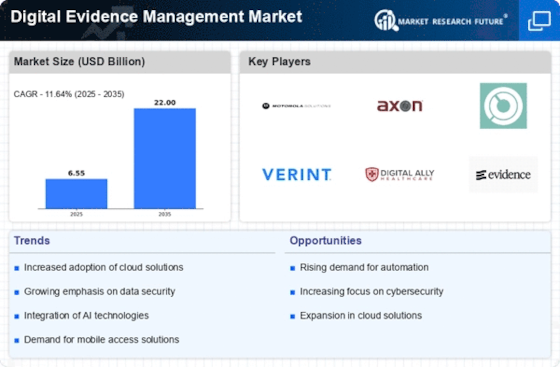

The Digital Evidence Management (DEM) marketplace is experiencing noteworthy developments that replicate the evolving landscape of virtual facts handling. One outstanding trend is the growing awareness of Artificial Intelligence (AI) and machine mastering (ML) integration inside DEM answers. As the extent and complexity of virtual evidence continue to grow, groups are turning to AI and ML to automate the evaluation system, allowing faster insights and more green investigations. These technologies decorate the abilities of DEM platforms by allowing capabilities like facial reputation, object detection, and pattern popularity, thereby accelerating the tempo at which investigators can extract significant information from virtual evidence.

Another noteworthy trend is the emphasis on cybersecurity within DEM solutions. With the rise in cyber threats and assaults, there is a growing realization that virtual evidence itself wishes for sturdy safety. Encryption, secure data transmission, and superior right of entry to controls are becoming essential additives of DEM structures. Security functions are not most effectively designed to shield the integrity of virtual proof but additionally to make certain that the whole DEM environment is proof against tampering or unauthorized right of entry, aligning with the paramount importance of maintaining the chain of custody in legal lawsuits. Interconnectivity and interoperability are emerging as vital developments influencing the DEM marketplace.

As agencies install a number of gears for special tiers of Digital Evidence Management, there's a growing demand for interoperable answers that can seamlessly combine with current systems. This fashion ambitions to remove facts silos, enhance collaboration, and create a unified atmosphere for Digital Evidence Management. Vendors are responding by way of growing answers that could, without difficulty, integrate with forensic gear, case management structures, and different relevant packages, ensuring a more cohesive and efficient workflow. Moreover, user-friendly interfaces and intuitive design are gaining prominence as important trends in the DEM marketplace. Recognizing that the cease-customers of DEM solutions vary from regulation enforcement professionals to criminal specialists with varying technical information, vendors are investing in creating interfaces that might be easy to navigate and understand. Intuitive layout now not only expedites the studying curve for users but additionally ensures that essential obligations, consisting of evidence ingestion and retrieval, may be finished without pointless complexity.

The international nature of digital investigations is fostering a trend towards standardization in DEM solutions. Standardization efforts are underway to cope with the demanding situations posed by way of pass-border investigations and the desire for international cooperation. The goal of these tasks is to establish common protocols and frameworks that enable the seamless sharing of virtual evidence throughout jurisdictions while ensuring compliance with legal and privacy regulations. Standardization traits are crucial for fostering collaboration amongst international law enforcement organizations and facilitating more effective responses to transnational cyber threats.

Leave a Comment