Increasing Criminal Activities

The rise in criminal activities, particularly cybercrime, is a significant driver of the Digital Evidence Management Market. As criminal organizations become more sophisticated, law enforcement agencies are faced with the challenge of managing an increasing volume of digital evidence. This trend necessitates the implementation of advanced digital evidence management solutions that can efficiently store, retrieve, and analyze evidence. The market is responding to this demand, with projections indicating a steady increase in investments in digital evidence management technologies. The need for effective evidence management systems is underscored by the growing complexity of investigations, which often involve multiple jurisdictions and diverse types of digital evidence. Consequently, the market is likely to experience sustained growth as agencies seek to enhance their capabilities in combating crime and ensuring justice.

Rising Demand for Data Security

The increasing emphasis on data security and compliance is a pivotal driver in the Digital Evidence Management Market. With the proliferation of cyber threats and data breaches, organizations are compelled to adopt robust digital evidence management solutions that ensure the integrity and confidentiality of sensitive information. Regulatory frameworks, such as the General Data Protection Regulation (GDPR), mandate stringent data protection measures, further propelling the demand for secure evidence management systems. As organizations strive to comply with these regulations, investments in advanced security features, such as encryption and access controls, are likely to rise. This trend not only safeguards digital evidence but also fosters trust among stakeholders, thereby contributing to the market's expansion. The market is expected to witness a surge in demand for solutions that prioritize data security, reflecting the growing awareness of the importance of protecting digital assets.

Adoption of Cloud-Based Solutions

The shift towards cloud-based solutions is significantly influencing the Digital Evidence Management Market. Organizations are increasingly recognizing the advantages of cloud technology, including scalability, cost-effectiveness, and enhanced collaboration capabilities. Cloud-based digital evidence management systems allow for real-time access to evidence from multiple locations, facilitating seamless communication among law enforcement agencies and legal teams. This trend is particularly relevant as the need for remote access to evidence becomes more pronounced. Market analysts project that the cloud segment will account for a substantial share of the digital evidence management market, with growth rates exceeding 20% in the coming years. The flexibility and efficiency offered by cloud solutions are likely to drive their adoption, enabling organizations to manage digital evidence more effectively and respond to evolving challenges in the field.

Integration of Artificial Intelligence

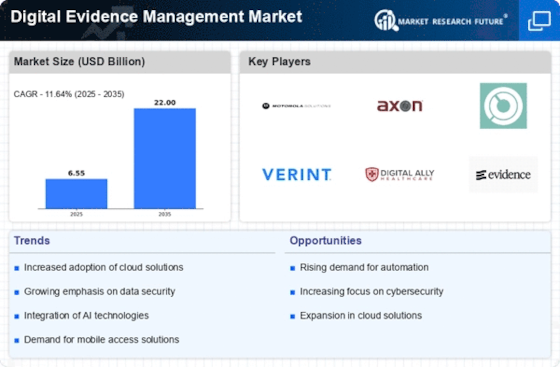

The integration of artificial intelligence (AI) into the Digital Evidence Management Market is transforming how law enforcement and legal entities handle evidence. AI technologies, such as machine learning and natural language processing, enhance the ability to analyze vast amounts of data quickly and accurately. This capability is particularly crucial as the volume of digital evidence continues to grow exponentially. According to recent estimates, the digital evidence management sector is projected to expand at a compound annual growth rate of over 15% through the next five years. AI-driven tools can automate routine tasks, allowing personnel to focus on more complex investigations. As a result, the adoption of AI in digital evidence management not only improves efficiency but also enhances the overall effectiveness of evidence handling, thereby driving market growth.

Focus on Interoperability and Integration

The emphasis on interoperability and integration within the Digital Evidence Management Market is becoming increasingly pronounced. As various law enforcement agencies and legal entities utilize different systems and technologies, the need for seamless integration of digital evidence management solutions is critical. Interoperability allows for the efficient sharing of evidence across platforms, enhancing collaboration and coordination among agencies. This trend is particularly relevant in multi-agency investigations, where the ability to access and share evidence in real-time can significantly impact case outcomes. Market forecasts suggest that solutions emphasizing interoperability will gain traction, as agencies seek to streamline their operations and improve the overall effectiveness of evidence management. The push for integrated systems is likely to drive innovation and investment in the digital evidence management sector, ultimately contributing to its growth.