Digital Camera Size

Market Size Snapshot

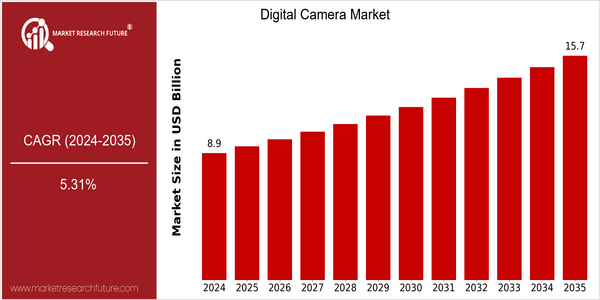

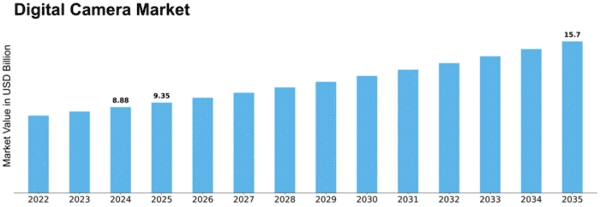

| Year | Value |

|---|---|

| 2024 | USD 8.87 Billion |

| 2035 | USD 15.69 Billion |

| CAGR (2025-2035) | 5.31 % |

Note – Market size depicts the revenue generated over the financial year

The digital camera market is set to grow significantly. The market is estimated to reach $8.87 billion in 2024 and to grow to $17.69 billion by 2035. This represents a CAGR of 5.31% from 2025 to 2035, which indicates a healthy demand for digital imaging solutions. Photography’s popularity, driven by the proliferation of social media and content creation, is one of the main driving forces behind this growth. Also, the improvements in camera technology, such as enhanced sensors, better image stabilization, and the introduction of artificial intelligence, are attracting both amateur and professional users. Canon, Nikon, and Sony are some of the leading players in the digital camera market. They are investing heavily in R&D to enhance their products’ capabilities. Strategic alliances with technology companies and the introduction of new camera models with advanced features are further boosting the market. The advent of mirrorless cameras has revolutionized the market. These compact and powerful devices are gaining traction among consumers. As the digital camera market evolves, it is expected to grow, driven by technological developments and the growing photography community.

Regional Market Size

Regional Deep Dive

The digital camera market is going through dynamic changes in all regions. It is being driven by technological changes, the changing tastes of consumers and the rise of social media. In North America, the market is characterized by a strong demand for high-quality image products, especially from professional photographers and content creators. In Europe, the demand is a mixture of the traditional interest in photography and the increasing interest in compact high-performance cameras. In the Asia-Pacific region, the rapid growth in income and the expanding middle class are driving the market. In the Middle East and Africa, the demand for image creation is rising. Latin America is smaller, but as the penetration of smart phones rises, it is gradually becoming a market for digital photography. Each region presents its own opportunities and challenges, which together create the general landscape of the digital camera market.

Europe

- Sustainability has become a key focus in Europe, with companies like Nikon and Fujifilm investing in eco-friendly manufacturing processes and recyclable materials for their products.

- The European Union's regulations on electronic waste are pushing manufacturers to develop more sustainable products, which is expected to reshape product design and lifecycle management in the digital camera market.

Asia Pacific

- The rapid adoption of smartphones with advanced camera capabilities is driving innovation in the digital camera market, with brands like Xiaomi and Huawei competing aggressively in the compact camera segment.

- Government initiatives in countries like Japan and South Korea are promoting digital content creation, leading to increased investments in camera technology and related industries.

Latin America

- The increasing penetration of smartphones is influencing the digital camera market, with brands like Samsung and LG focusing on enhancing camera features to attract consumers.

- Economic fluctuations in the region are prompting consumers to seek affordable yet high-quality camera options, leading to a rise in demand for entry-level digital cameras.

North America

- The rise of mirrorless camera technology has significantly influenced the North American market, with companies like Sony and Canon leading the charge in innovation and product offerings.

- Social media platforms such as Instagram and TikTok have spurred demand for high-quality cameras among influencers and content creators, prompting brands to tailor their marketing strategies accordingly.

Middle East And Africa

- The growth of tourism in the Middle East is boosting the demand for digital cameras, with brands like Canon and Nikon actively marketing their products to travelers and photographers.

- Local photography competitions and festivals are emerging, encouraging amateur photographers to invest in higher-quality cameras and equipment.

Did You Know?

“Did you know that despite the rise of smartphones, the global demand for digital cameras has remained resilient, with a notable increase in sales of mirrorless cameras in recent years?” — CIPA (Camera & Imaging Products Association)

Segmental Market Size

The digital camera market is currently experiencing a steady demand, as consumers’ appetite for high-quality photography and filming is increasing. The main growth drivers are the growing importance of social media platforms that place great emphasis on visual content, as well as technological improvements such as image sensors and image stabilisation. Also, the interest of influencers and professionals in content creation is driving demand for advanced digital cameras. The market is currently in a mature stage of development, with Canon, Nikon and Sony leading the way in innovation and product development. North America and Europe are particularly strong in the professional photography and filmmaking segments. The most important applications are event photography, nature photography and vlogging, where high-resolution images and videos are essential. Mirrorless cameras and the increasing use of artificial intelligence in photography are expected to boost growth. At the same time, the sustainable development trends are pushing manufacturers to develop more eco-friendly products.

Future Outlook

The digital camera market is set to grow at a CAGR of 5.31 per cent from 2024 to 2035. The growth will be fueled by the increasing demand for high-quality image solutions in various sectors, such as professional photography, content creation, and social media. As more and more people and businesses recognize the importance of high-quality visual content, the penetration of digital cameras will grow, and could reach 30 per cent in the content creation and professional photography sector by 2035. The growth will also be driven by the integration of artificial intelligence into the camera functions, enhanced image sensors, and improved connectivity. In addition, the rising popularity of live streaming and vlogging will increase the demand for compact and versatile digital cameras. The importance of sustainable and eco-friendly products and solutions is also growing, and will influence consumers’ preferences and buying decisions. These changes will provide opportunities for manufacturers that focus on innovation and sustainable solutions.

Leave a Comment