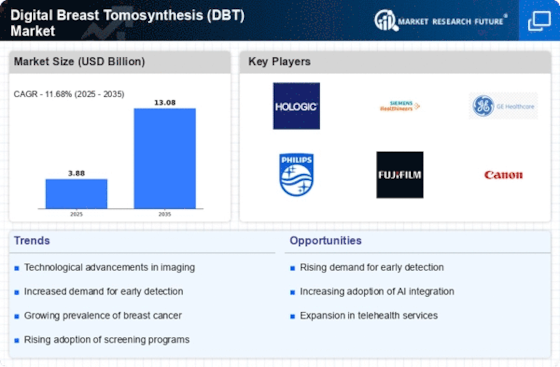

The Digital Breast Tomosynthesis Market is currently characterized by a dynamic competitive landscape, driven by technological advancements and an increasing emphasis on early breast cancer detection. Key players such as Hologic (US), GE Healthcare (US), and Siemens Healthineers (DE) are at the forefront, each adopting distinct strategies to enhance their market positioning. Hologic (US) focuses on innovation, particularly in developing advanced imaging technologies that improve diagnostic accuracy. Meanwhile, GE Healthcare (US) emphasizes partnerships with healthcare providers to expand its reach and integrate its solutions into existing healthcare infrastructures. Siemens Healthineers (DE) is leveraging digital transformation initiatives to streamline operations and enhance patient outcomes, thereby shaping a competitive environment that prioritizes technological superiority and operational efficiency.

In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to enhance responsiveness to market demands. The competitive structure of the Digital Breast Tomosynthesis Market appears moderately fragmented, with several key players exerting influence over various segments. This fragmentation allows for a diverse range of offerings, yet the collective impact of major companies like Hologic (US) and GE Healthcare (US) is significant, as they set benchmarks for innovation and service delivery.

In January 2026, Hologic (US) announced the launch of its latest 3D mammography system, which incorporates artificial intelligence (AI) to enhance image analysis. This strategic move is likely to bolster Hologic's competitive edge by providing healthcare professionals with tools that improve diagnostic accuracy and reduce reading times. The integration of AI into imaging systems is indicative of a broader trend towards digitalization in the healthcare sector, which is expected to redefine operational standards.

In December 2025, Siemens Healthineers (DE) entered a strategic partnership with a leading telehealth provider to enhance remote diagnostic capabilities. This collaboration is poised to expand access to tomosynthesis services, particularly in underserved regions, thereby aligning with the growing demand for telehealth solutions. Such partnerships not only enhance service delivery but also position Siemens Healthineers (DE) as a leader in integrating advanced imaging technologies with telehealth platforms.

In November 2025, GE Healthcare (US) unveiled a new initiative aimed at sustainability in its manufacturing processes, focusing on reducing waste and energy consumption. This initiative reflects a growing trend towards environmentally responsible practices within the healthcare sector, which may resonate well with stakeholders increasingly concerned about sustainability. By prioritizing eco-friendly operations, GE Healthcare (US) is likely to enhance its brand reputation and appeal to a broader customer base.

As of February 2026, the Digital Breast Tomosynthesis Market is witnessing trends that emphasize digitalization, sustainability, and AI integration. Strategic alliances are becoming increasingly pivotal, as companies recognize the value of collaborative efforts in enhancing service delivery and operational efficiency. Looking ahead, competitive differentiation is expected to evolve, shifting from price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This transition suggests that companies that prioritize these aspects will likely emerge as leaders in the market.