Market Trends

Key Emerging Trends in the Diesel Engine Catalyst Market

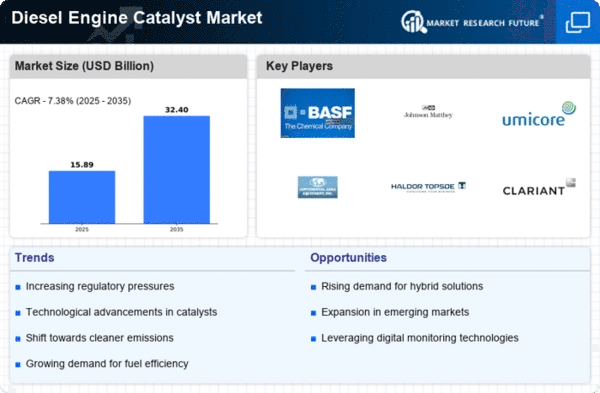

All the evolution of the diesel engine catalyst market trends is based on several drivers that influence the automotive and industrial world. A significant trend is the increased focus on the environmental sustainability and regulation. All over the world, governments are putting in place various strict emission standards to address many issues around air quality and climate change. Thus, there is a rising need for the sophisticated catalyst technologies that can eliminate harmful emissions from the diesel engines. Another very interesting tendency is the ever-growing generation of new catalyst materials and also designs. The diesel engine catalyst market manufacturers are spending a significant amount of time and capital on research for developing highly efficient and long-lasting catalyst. Better catalysts not only help to comply with the emission standards but also contribute to improving the overall performance of an engine. This trend is motivated by the need for improved and dependable solutions to respond to the fast- developing needs of automotive as well as the industrial sectors. Diesel engine catalyst market trends have also been greatly affected by the emergence of the electric vehicles (EVs). Although electric vehicles are increasingly becoming popular in the market, diesel engines remain a very important element of heavy-duty applications like trucks, buses and industrial equipment. As a result, there is alot of parallel attention to the improvement of catalyst technologies that can clean up the diesel engines and make them much less polluting. This move is a great reflection of the ability of this industry to quickly adjust as well as the coexistence among many propulsion technologies. In addition, globalization and international trade act as the factors which impact the diesel engine catalyst market. However, as the industrial activities and transportation networks go global in their scale, the demand for diesel engines increases globally. This has contributed to an increase in the uptake of catalyst solutions around different regions so as to meet the diverse emission controls. Market competitors are actively ensuring that their products and services serve an increasingly global customer base, thereby driving the development of the diesel engine catalyst markets. Cost-effectiveness is a another very important contributor to the market trends. Manufacturers are focussed on the development of catalyst solutions that do not only help to comply with the environmental standards but also fit into the users’ budgets. As to the catalyst technologies, they should become more affordable as there are some industries that cannot work without the diesel engines. This trend reveals the industry's dedication to offering affordable and environmentally friendly methods, leading it to widely spread across various industries.

Leave a Comment