Regulatory Compliance

Regulatory frameworks are significantly influencing the Dibutyl Maleate Market. Stricter regulations regarding chemical safety and environmental impact are prompting manufacturers to ensure compliance with international standards. This compliance often necessitates the reformulation of products, which can lead to increased demand for dibutyl maleate as a safer alternative to more hazardous substances. Companies that proactively adapt to these regulations may find themselves at a competitive advantage, as they can market their products as compliant and environmentally friendly. Furthermore, the ongoing evolution of regulatory policies may create opportunities for innovation within the industry, as firms seek to develop new formulations that meet or exceed these standards.

Technological Innovations

Technological advancements play a pivotal role in shaping the Dibutyl Maleate Market. Innovations in production processes, such as improved synthesis methods and enhanced purification techniques, are likely to increase efficiency and reduce costs. These advancements may lead to higher quality dibutyl maleate, which is essential for various applications, including plasticizers and coatings. The market is witnessing a trend towards automation and digitalization, which could streamline operations and enhance product consistency. As companies invest in research and development, the introduction of novel applications for dibutyl maleate may emerge, further expanding its market reach. This technological evolution is expected to bolster the overall growth trajectory of the industry.

Sustainability Initiatives

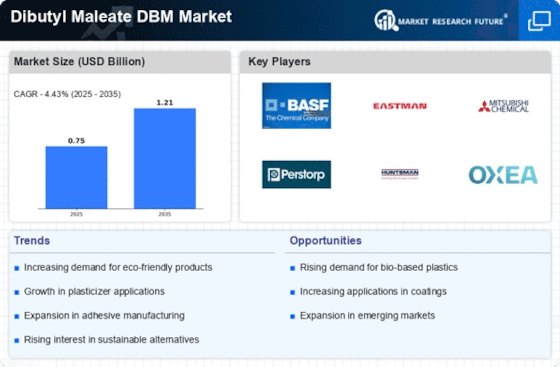

The increasing emphasis on sustainability within the Dibutyl Maleate Market is driving demand for eco-friendly alternatives. Manufacturers are increasingly adopting sustainable practices, which include the use of renewable resources and the reduction of harmful emissions. This shift is not only in response to regulatory pressures but also consumer preferences for greener products. As a result, companies that prioritize sustainability are likely to gain a competitive edge. The market for dibutyl maleate is projected to grow as industries seek to align with environmental standards, potentially leading to a rise in production capacities. Furthermore, the integration of sustainable practices may enhance brand loyalty among environmentally conscious consumers, thereby influencing purchasing decisions.

Expanding Application Scope

The expanding application scope of dibutyl maleate is a key driver for the market. This compound is increasingly being utilized in various industries, including pharmaceuticals, agriculture, and personal care products. Its unique properties, such as its ability to act as a plasticizer and a solvent, make it suitable for a wide range of formulations. The pharmaceutical sector, for instance, is exploring dibutyl maleate for use in drug delivery systems, which could enhance the efficacy of medications. As new applications are discovered, the demand for dibutyl maleate is likely to rise, thereby propelling growth within the Dibutyl Maleate Market. This trend suggests a promising future for manufacturers willing to explore innovative uses for this versatile compound.

Rising Demand in End-User Industries

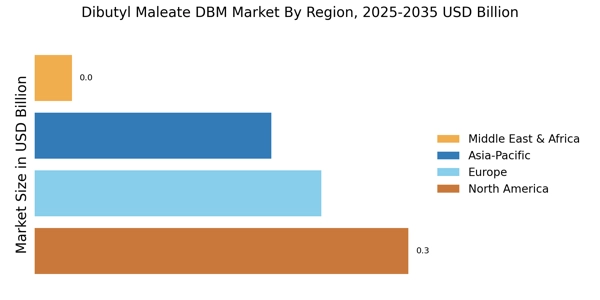

The Dibutyl Maleate Market is experiencing a surge in demand from various end-user sectors, including automotive, construction, and consumer goods. The automotive industry, in particular, is increasingly utilizing dibutyl maleate in the production of flexible and durable materials. This trend is driven by the need for lightweight components that enhance fuel efficiency. Additionally, the construction sector is adopting dibutyl maleate for its properties that improve the performance of adhesives and sealants. Market data indicates that the demand for dibutyl maleate in these sectors is expected to grow at a compound annual growth rate (CAGR) of approximately 5% over the next few years, reflecting the material's versatility and applicability.