Dextrose Market Summary

As per Market Research Future analysis, the Dextrose Market Size was estimated at 3781.4 USD Million in 2024. The Dextrose industry is projected to grow from 3921.31 USD Million in 2025 to 5639.22 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 3.7% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Dextrose Market is experiencing robust growth driven by health trends and technological advancements.

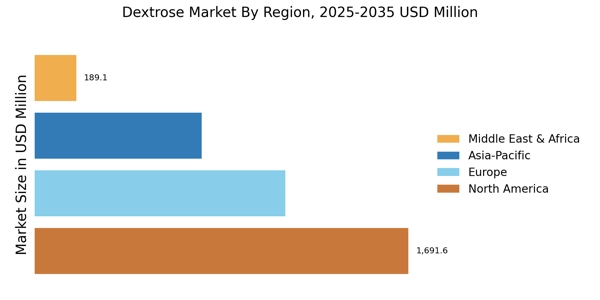

- The market is witnessing a rising demand in health-conscious segments, particularly in North America.

- Pharmaceutical applications are expanding, contributing to the overall market growth in the Asia-Pacific region.

- Dextrose Market Monohydrate remains the largest segment, while Dextrose Market Anhydrous is emerging as the fastest-growing segment.

- Key market drivers include the increasing use of dextrose in the food and beverage sector and technological advancements in production.

Market Size & Forecast

| 2024 Market Size | 3781.4 (USD Million) |

| 2035 Market Size | 5639.22 (USD Million) |

| CAGR (2025 - 2035) | 3.7% |

Major Players

Cargill (US), Archer Daniels Midland (US), Tate & Lyle (GB), Roquette Freres (FR), Ingredion (US), MGP Ingredients (US), Grain Processing Corporation (US), Mitsubishi Corporation (JP), Südzucker AG (DE)