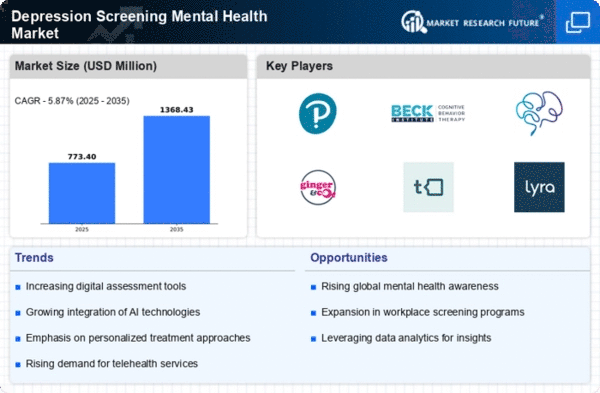

Market Growth Projections

The Global Depression Screening Market Industry is projected to experience substantial growth over the coming years. With a market value of 0.73 USD Billion in 2024, it is anticipated to reach 1.37 USD Billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.86% from 2025 to 2035. This growth is driven by various factors, including the rising prevalence of depression, increased awareness of mental health, and advancements in screening technologies. As stakeholders in the healthcare sector recognize the importance of early detection and intervention, the market is likely to expand, presenting opportunities for innovation and investment.

Rising Prevalence of Depression

The increasing prevalence of depression globally serves as a primary driver for the Global Depression Screening Market Industry. Recent statistics indicate that approximately 264 million individuals are affected by depression worldwide, highlighting a pressing need for effective screening methods. As awareness of mental health issues grows, healthcare systems are prioritizing early detection and intervention strategies. This trend is likely to bolster the demand for screening tools and services, contributing to the market's projected growth from 0.73 USD Billion in 2024 to an estimated 1.37 USD Billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.86% from 2025 to 2035.

Government Initiatives and Funding

Government initiatives aimed at improving mental health services significantly influence the Global Depression Screening Market Industry. Various countries are implementing policies that promote mental health awareness and allocate funding for screening programs. For instance, national health services are increasingly integrating depression screening into routine healthcare practices, thereby enhancing accessibility. Such initiatives not only encourage healthcare providers to adopt screening protocols but also facilitate the development of innovative screening tools. This supportive environment is expected to drive market growth, as evidenced by the projected increase in market value from 0.73 USD Billion in 2024 to 1.37 USD Billion by 2035.

Increased Awareness of Mental Health

The growing awareness of mental health issues among the global population significantly drives the Global Depression Screening Market Industry. Public campaigns and educational programs are fostering a better understanding of depression, its symptoms, and the importance of early detection. This heightened awareness encourages individuals to seek screening and treatment, thereby increasing the demand for screening services. As mental health becomes a priority in public health discussions, healthcare providers are more likely to implement screening protocols. The market is projected to grow from 0.73 USD Billion in 2024 to 1.37 USD Billion by 2035, reflecting the positive correlation between awareness and market expansion.

Integration of Screening in Primary Care

The integration of depression screening into primary care settings is a vital driver for the Global Depression Screening Market Industry. Healthcare providers are increasingly recognizing the importance of addressing mental health within general health services. This integration allows for early identification and management of depression, improving overall patient care. As primary care physicians adopt standardized screening tools, the demand for these tools is expected to rise. The market's growth trajectory, from 0.73 USD Billion in 2024 to 1.37 USD Billion by 2035, illustrates the potential impact of this integration on enhancing screening practices and expanding market opportunities.

Technological Advancements in Screening Tools

Technological advancements play a crucial role in shaping the Global Depression Screening Market Industry. The integration of artificial intelligence and machine learning into screening tools enhances their accuracy and efficiency, allowing for more effective identification of depression symptoms. Innovations such as mobile applications and telehealth platforms facilitate remote screening, making it easier for individuals to access mental health services. These advancements not only improve patient outcomes but also expand the market reach, as more healthcare providers adopt these technologies. The anticipated growth from 0.73 USD Billion in 2024 to 1.37 USD Billion by 2035 underscores the impact of technology on market dynamics.