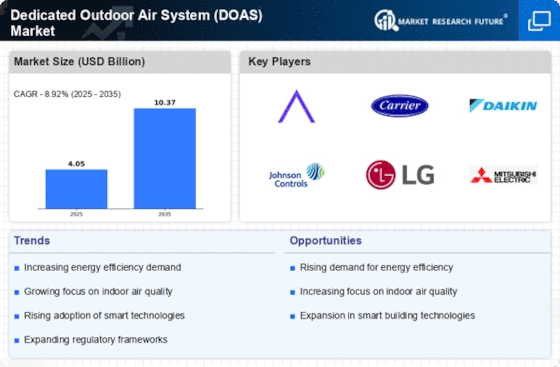

Growing Construction Activities

The surge in construction activities across various sectors is a crucial driver for the Dedicated Outdoor Air System Market (DOAS) Market. As urbanization continues to rise, there is a corresponding increase in the demand for new residential, commercial, and industrial buildings. This trend necessitates the incorporation of efficient ventilation systems, such as DOAS, to meet regulatory requirements and enhance occupant comfort. According to recent data, the construction industry is projected to grow at a steady rate, further fueling the need for advanced HVAC solutions. The integration of DOAS in new constructions not only ensures compliance with ventilation standards but also promotes energy efficiency, making it an attractive option for builders and developers. Consequently, the expanding construction sector is likely to bolster the DOAS market in the coming years.

Rising Demand for Indoor Air Quality

The increasing awareness regarding indoor air quality is a pivotal driver for the Dedicated Outdoor Air System Market (DOAS) Market. As individuals spend a significant portion of their time indoors, the demand for systems that ensure clean and fresh air is paramount. Studies indicate that poor indoor air quality can lead to various health issues, prompting both residential and commercial sectors to invest in advanced ventilation solutions. The DOAS technology, which provides a continuous supply of outdoor air while maintaining energy efficiency, is becoming increasingly popular. This trend is further supported by the growing number of building codes and standards that emphasize the importance of adequate ventilation. Consequently, the market for DOAS is likely to expand as more stakeholders recognize the necessity of maintaining high indoor air quality standards.

Technological Advancements in HVAC Systems

Technological innovations in heating, ventilation, and air conditioning (HVAC) systems are significantly influencing the Dedicated Outdoor Air System Market (DOAS) Market. The integration of advanced technologies such as variable refrigerant flow, energy recovery ventilators, and smart controls enhances the efficiency and performance of DOAS. These advancements not only improve energy efficiency but also facilitate better control over indoor environments. For instance, the implementation of IoT-enabled devices allows for real-time monitoring and adjustments, optimizing energy consumption. As a result, the market is witnessing a shift towards more sophisticated DOAS solutions that cater to the evolving needs of consumers. The increasing adoption of these technologies is expected to drive growth in the DOAS market, as stakeholders seek to leverage the benefits of modern HVAC systems.

Shift Towards Sustainable Building Practices

The ongoing shift towards sustainable building practices is a vital driver for the Dedicated Outdoor Air System Market (DOAS) Market. As environmental concerns gain prominence, builders and developers are increasingly prioritizing eco-friendly construction methods and materials. DOAS plays a crucial role in this transition by providing efficient ventilation solutions that reduce energy consumption and carbon footprints. The emphasis on sustainability is reflected in the growing number of green building certifications, which often require the implementation of advanced ventilation systems. This trend is likely to encourage the adoption of DOAS technologies, as stakeholders aim to meet sustainability goals while ensuring occupant comfort. The increasing alignment of the construction industry with sustainable practices is expected to significantly contribute to the growth of the DOAS market.

Increased Regulatory Focus on Energy Efficiency

The heightened regulatory focus on energy efficiency is a significant driver for the Dedicated Outdoor Air System Market (DOAS) Market. Governments and regulatory bodies are increasingly implementing stringent energy codes and standards aimed at reducing energy consumption in buildings. These regulations often mandate the use of energy-efficient ventilation systems, which positions DOAS as a favorable solution. The ability of DOAS to provide conditioned outdoor air while minimizing energy loss aligns well with these regulatory requirements. As a result, stakeholders in the construction and HVAC sectors are more inclined to adopt DOAS technologies to ensure compliance and enhance sustainability. This regulatory push is expected to propel the growth of the DOAS market, as more entities seek to align with energy efficiency goals.