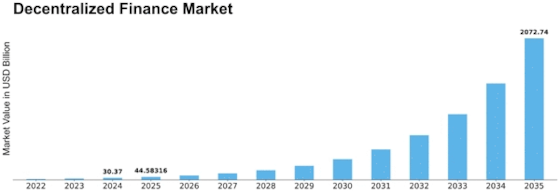

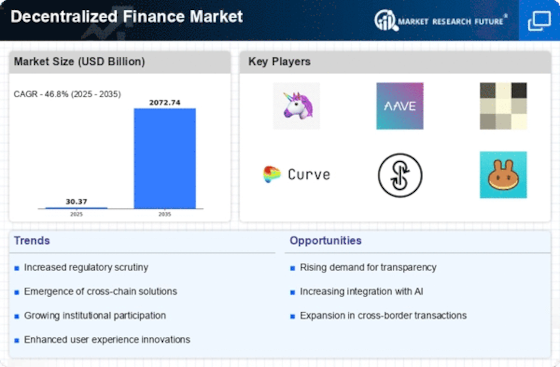

Decentralized Finance Size

Decentralized Finance Market Growth Projections and Opportunities

DeFi, or Decentralized Finance to some people stands for a big change in the usual way finance works. Some important things help the Decentralized Finance market grow and stay active. Most importantly, these money systems do not have a central place in charge. Unlike regular money systems that need banks and financial places, DeFi uses blockchain methods. It also makes use of smart agreements to do transactions without needing anyone in between. This setup makes things safer, more open and easier to get. Another important reason driving the DeFi market is the idea of money that can be controlled by programs. Smart contracts, which are agreements that run by themselves and have the rules written right into code, let you make deals in money matters with programming. This kind of money can be used to do many things with your money. These include lending, borrowing and buying without anyone having to step in manually. This is done by computers that have been set up for the job first. Working well together is very important in the area of money managed without a central authority. Many DeFi projects use open blockchain networks. This helps different platforms and apps to work together easily. This ability lets users easily shift their things and use different money services across lots of DeFi rules. This makes the system get more linked up and smoother to run. In addition, the idea of liquidity pools is very important in the DeFi market. Liquidity pools are a system that lets users trade assets directly from the group without using old ways like order books. This is done through an automated and big decentralized market structure. People put money in these groups to get back fees. This helps trading go better and faster throughout the DeFi world. Decentralized Finance gets strong from the idea of letting anyone use it without asking for permission. Usual money systems sometimes need hard processes and rules for people to get financial help. On the other hand, DeFi platforms are available to anyone with internet access and a suitable wallet. This openness removes obstacles and lets people worldwide take part in decentralized money activities.

Leave a Comment