Top Industry Leaders in the Decentralized Finance Market

Competitive Landscape of Decentralized Finance Market

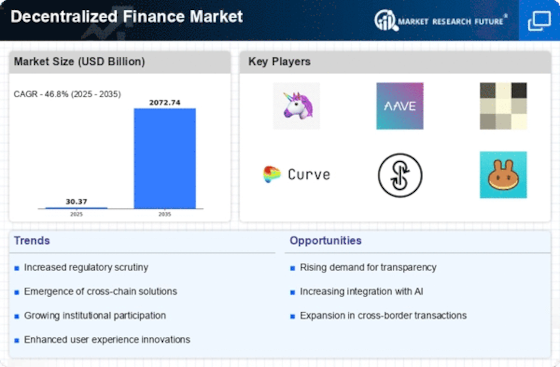

Decentralized finance (DeFi) has emerged as a transformative force in the financial sector, challenging traditional centralized systems with its promise of transparency, efficiency, and accessibility. As the DeFi ecosystem continues to expand, a vibrant competitive landscape has developed, with established players vying for dominance and innovative newcomers seeking to disrupt the status quo.

Key Players in DeFi

- Compound Labs, Inc.

- MakerDAO

- Aave

- SushiSwap

- Curve Finance

- Synthetix

- Balancer

- Bancor Network

- Badger DAO

- Uniswap

Strategies Adopted by DeFi Players

Decentralized finance players employ various strategies to gain a competitive advantage and establish themselves in the market. These strategies include:

- Innovation: DeFi protocols are constantly innovating, introducing new products, features, and mechanisms to attract users and enhance their offerings.

- Staking and Yield Farming: DeFi platforms offer staking and yield farming mechanisms that incentivize users to provide liquidity and earn rewards.

- Community Engagement: DeFi protocols foster strong community engagement by involving token holders in decision-making processes and providing transparent communication channels.

- Cross-Chain Integration: DeFi protocols are increasingly integrating with multiple blockchains to expand their reach and cater to a broader user base.

Factors for Market Share Analysis

Several factors contribute to a DeFi protocol's market share, including:

- Volume of Transactions: The volume of transactions processed through a protocol reflects its popularity and adoption.

- Total Value Locked (TVL): TVL represents the total amount of cryptocurrency assets deposited in a protocol, indicating the trust that users place in the protocol's security and stability.

- Community Size and Engagement: A large and active community can contribute to a protocol's success by providing feedback, promoting adoption, and influencing development decisions.

- Unique Features and Innovation: Protocols that offer unique features, innovative products, or advanced functionalities can attract users and gain a competitive edge.

New and Emerging Companies in DeFi

The DeFi landscape is constantly evolving, with new and emerging companies entering the market to challenge the established players and bring fresh perspectives to the sector. These companies are focusing on various areas, including:

- Decentralized Derivatives: Decentralized exchanges are exploring the development of derivatives trading, offering options, futures, and other sophisticated financial instruments.

- Decentralized Insurance: DeFi protocols are venturing into the insurance space, providing cover against smart contract risks, price fluctuations, and other potential losses.

- Decentralized Custody: DeFi players are developing secure custody solutions that protect user funds without compromising decentralization principles.

- Cross-Chain DeFi: DeFi protocols are bridging between different blockchains to enable seamless asset transfers and facilitate cross-chain applications.

Current Company Investment Trends

Investment activity in the DeFi sector remains strong, with venture capitalists and institutional investors recognizing the potential of decentralized finance to disrupt traditional financial markets. Key investment trends include:

- Focus on Infrastructure: Investors are backing projects that develop the underlying infrastructure for DeFi, including blockchain networks, decentralized oracles, and decentralized identity solutions.

- Support for Innovation: Investors are seeking out innovative DeFi protocols that address emerging needs and introduce groundbreaking solutions.

- emphasis on Security: Investors are increasingly prioritizing security as a criterion for investment, ensuring that DeFi protocols adhere to robust security practices.

- Alignment with Regulatory Frameworks: Investors are looking for DeFi projects that actively engage with regulators to ensure compliance and foster a more regulated and sustainable DeFi ecosystem.

Updated News

January 31, 2024

- Founders Fund-backed Layer N hits 120K TPS in testing ahead of February public testnet. Layer N has successfully tested its ability to process 120,000 transactions per second (TPS) in its private testnet. The company is planning to launch a public testnet in February.

- Bitcoin-based DEX Portal raises $34 million in seed funding from Coinbase Ventures and others. Portal, a new decentralized exchange (DEX) that allows users to trade Bitcoin and other cryptocurrencies, has raised $34 million in seed funding from Coinbase Ventures and other investors.

January 30, 2024

- Starknet collaborates with Celestia on data availability for Layer 3 ecosystem. Starknet, a Layer 2 scaling solution for Ethereum, has partnered with Celestia to provide data availability for its Layer 3 ecosystem.

- Memecoin Floki blocks Hong Kong users from staking programs amid regulatory warnings. The memecoin Floki has blocked Hong Kong users from participating in its staking programs due to regulatory concerns.

January 29, 2024

- Newly OKX-backed Layer 2 bridge Orbiter Finance announces its own L2 network. Orbiter Finance, a new Layer 2 bridge backed by OKX, has announced its own Layer 2 network.

- Number of Pyth stakers exceed 110,000 as community participation surges. The number of Pyth stakers has exceeded 110,000 as community participation in the decentralized oracle network surges.