Increased Focus on Customer Experience

An increased focus on customer experience is emerging as a crucial driver in the Debt Collection Software Market Industry. Organizations are recognizing that a positive customer experience during the debt collection process can lead to better recovery rates and improved brand loyalty. As a result, debt collection software is being designed with features that prioritize customer engagement and communication. This includes personalized messaging, flexible payment plans, and user-friendly interfaces. By adopting a more empathetic approach to debt collection, companies can foster better relationships with their customers, which may ultimately lead to higher recovery rates. The emphasis on customer experience reflects a broader trend within the industry, where businesses are striving to balance effective debt recovery with maintaining a positive brand image.

Shift Towards Digital Payment Solutions

The shift towards digital payment solutions is a significant driver in the Debt Collection Software Market Industry. As consumers increasingly prefer digital transactions, businesses are adapting their collection strategies to align with these preferences. The rise of e-commerce and mobile payment platforms has transformed the way debts are collected, making it essential for debt collection software to integrate with various payment methods. This trend is reflected in the growing number of software solutions that offer seamless payment processing capabilities. By facilitating easy and convenient payment options, companies can enhance the likelihood of debt recovery while improving customer satisfaction. The integration of digital payment solutions not only streamlines the collection process but also positions businesses to meet the evolving expectations of consumers in a rapidly changing financial landscape.

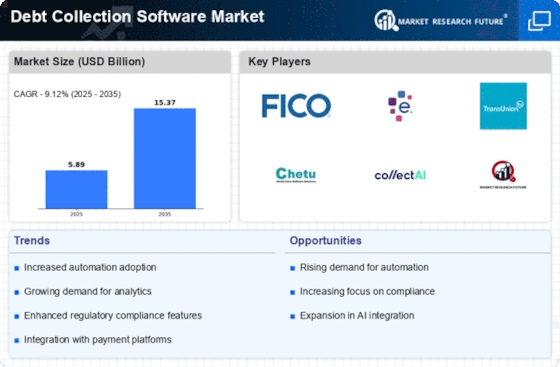

Rising Demand for Debt Recovery Solutions

The Debt Collection Software Market Industry is experiencing a notable increase in demand for effective debt recovery solutions. As businesses face mounting financial pressures, the need for efficient debt collection processes becomes paramount. According to recent data, the market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the increasing number of delinquent accounts and the necessity for organizations to recover outstanding debts promptly. Companies are increasingly adopting software solutions that streamline the collection process, enhance communication with debtors, and improve overall recovery rates. The rising demand for these solutions indicates a shift towards more sophisticated debt management practices, which are essential for maintaining cash flow and financial stability.

Technological Advancements in Debt Collection

Technological advancements are significantly shaping the Debt Collection Software Market Industry. The integration of innovative technologies such as artificial intelligence and machine learning is transforming traditional debt collection methods. These technologies enable organizations to analyze vast amounts of data, predict debtor behavior, and tailor collection strategies accordingly. As a result, companies can enhance their collection efficiency and reduce operational costs. The market is witnessing a surge in the adoption of cloud-based solutions, which offer scalability and flexibility. Furthermore, the incorporation of automated communication tools allows for timely follow-ups and improved customer engagement. This technological evolution not only streamlines the collection process but also fosters a more customer-centric approach, which is increasingly valued in today's competitive landscape.

Regulatory Changes and Compliance Requirements

The Debt Collection Software Market Industry is heavily influenced by regulatory changes and compliance requirements. Governments worldwide are implementing stricter regulations to protect consumers from aggressive collection practices. This has led to an increased focus on compliance among debt collection agencies and businesses. As a result, there is a growing need for software solutions that ensure adherence to these regulations while maintaining effective collection strategies. Companies are investing in debt collection software that includes features for compliance tracking, reporting, and documentation. This trend is expected to drive market growth, as organizations seek to mitigate legal risks and enhance their reputations. The emphasis on compliance not only safeguards consumers but also promotes ethical practices within the industry, ultimately benefiting all stakeholders involved.