Market Trends

Key Emerging Trends in the Data Encryption Market

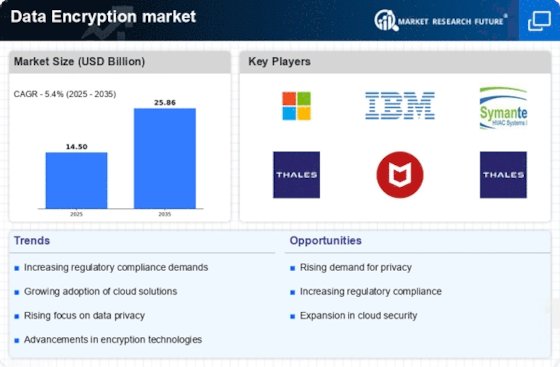

The data encryption market is witnessing numerous wonderful trends that are reshaping the landscape of virtual safety. One prominent trend is the development of encryption-as-a-provider (EaaS) fashions. Organizations are increasingly spotting the blessings of outsourcing their encryption needs to specialized service providers.

EaaS offers a value-effective and scalable solution, allowing organizations to leverage advanced encryption technology without the want for enormous in-residence know-how. This trend is mainly useful for small and medium-sized enterprises (SMEs) that could lack the resources to install and manage comprehensive encryption solutions independently. The increasing integration of encryption into endpoint protection answers is likewise a noteworthy trend within the marketplace. As the range of linked gadgets continues to develop, securing endpoints along with laptops, smartphones, and IoT devices turns into a critical challenge.

The trend in embedding encryption immediately into endpoint security solutions guarantees that statistics are protected on the source, reducing the chance of unauthorized access and records breaches. Furthermore, the marketplace is witnessing an accelerated consciousness of consumer-pleasant encryption solutions. Traditionally, encryption has been perceived as complex and difficult to put in force. In response to this, vendors are growing answers with simplified consumer interfaces, automation features, and intuitive key control structures. The demand for homomorphic encryption is emerging as a key fashion, particularly in industries coping with sensitive and personal information. Homomorphic encryption allows computations to be finished on encrypted statistics without decrypting it, preserving the confidentiality of records all through processing. This fashion is specifically relevant in sectors that include healthcare, finance, and government, in which privacy issues are paramount and stable facts processing is essential.

The data encryption market is characterized by way of various developments, which include the adoption of encryption-as-a-service, the improvement of quantum-resistant encryption, integration with endpoint safety, cloud-local encryption solutions, person-friendly interfaces, the rise of homomorphic encryption, and expanded collaboration amongst industry gamers. These tendencies collectively contribute to the market's evolution, reflecting a proactive reaction to the ever-converting panorama of cybersecurity threats and the growing importance of securing virtual information.

Leave a Comment