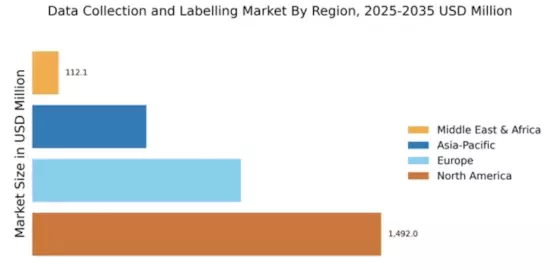

North America : Market Leader in Data Solutions

North America continues to lead the Data Collection and Labelling Market, holding a significant market share of 1492.05M in 2024. The region's growth is driven by the increasing demand for AI and machine learning applications, which require high-quality labeled data. Regulatory support for data privacy and security is also a catalyst, ensuring compliance while fostering innovation in data solutions. The competitive landscape is robust, with key players like Appen, Lionbridge, and Scale AI dominating the market. The U.S. is the primary contributor, leveraging its technological advancements and skilled workforce. Companies are increasingly investing in automation and AI-driven tools to enhance efficiency and accuracy in data labeling, further solidifying North America's position as a market leader.

Europe : Emerging Hub for Data Services

Europe's Data Collection and Labelling Market is projected at 892.23M, reflecting a growing demand for data-driven insights across various sectors. The region benefits from stringent data protection regulations, such as GDPR, which enhance consumer trust and drive the need for compliant data solutions. This regulatory framework acts as a catalyst for innovation, pushing companies to adopt advanced data collection methods. Leading countries like Germany and the UK are at the forefront, with a competitive landscape featuring players like Clickworker and other local firms. The presence of established tech hubs fosters collaboration between businesses and research institutions, enhancing the quality of data services. As companies increasingly focus on ethical AI, the demand for high-quality labeled data is expected to rise significantly.

Asia-Pacific : Rapidly Growing Data Market

The Asia-Pacific region, with a market size of 487.82M, is rapidly emerging as a key player in the Data Collection and Labelling Market. The growth is fueled by the increasing adoption of AI technologies and the rising demand for data analytics across various industries. Countries like India and China are investing heavily in digital infrastructure, which is essential for data collection and processing, thus driving market expansion. The competitive landscape is diverse, with companies like iMerit and CloudFactory leading the charge. The region's unique blend of cost-effective labor and technological innovation makes it an attractive destination for data services. As businesses seek to leverage data for competitive advantage, the demand for efficient and accurate data labeling solutions is expected to surge, positioning Asia-Pacific as a significant player in the global market.

Middle East and Africa : Emerging Data Solutions Frontier

The Middle East and Africa region, with a market size of 112.1M, is witnessing a gradual but steady growth in the Data Collection and Labelling Market. The increasing focus on digital transformation and the adoption of AI technologies are key drivers of this growth. Governments in the region are implementing initiatives to enhance digital infrastructure, which is crucial for data collection and analytics. Countries like South Africa and the UAE are leading the way, with a growing number of startups and established firms entering the data services space. The competitive landscape is evolving, with local players and international firms collaborating to meet the rising demand for data solutions. As the region continues to invest in technology, the potential for growth in data collection and labeling services is significant.