Emergence of Edge Computing

The Data Center Switch Market is witnessing a transformative shift with the emergence of edge computing. As organizations seek to process data closer to the source, the demand for edge data centers is increasing. This trend is projected to drive the data center switch market, with estimates suggesting a growth rate of 25% over the next five years. Edge computing reduces latency and enhances the performance of applications, making it essential for industries such as IoT and real-time analytics. Consequently, data center switch manufacturers are adapting their products to cater to the unique requirements of edge environments. This adaptation is likely to foster innovation and competition within the Data Center Switch Market, as companies strive to provide solutions that meet the specific needs of edge computing.

Increased Focus on Network Security

The Data Center Switch Market is increasingly shaped by the heightened focus on network security. As cyber threats become more sophisticated, organizations are prioritizing the implementation of secure networking solutions. The data center switch market is projected to grow by 18% as companies invest in switches that offer advanced security features, such as encryption and intrusion detection. This trend reflects a broader recognition of the importance of safeguarding sensitive data and maintaining compliance with regulatory standards. Consequently, manufacturers are innovating their product lines to incorporate robust security measures, thereby enhancing the overall value proposition of their offerings. This emphasis on security is likely to drive growth within the Data Center Switch Market, as organizations seek to protect their digital assets.

Expansion of Data Center Infrastructure

The Data Center Switch Market is significantly influenced by the ongoing expansion of data center infrastructure. As businesses increasingly migrate to digital platforms, the demand for robust data center facilities rises. According to recent estimates, the number of data centers is expected to grow by 15% annually, necessitating the deployment of advanced switching solutions. This expansion is driven by the need for improved data management, storage capabilities, and enhanced security measures. Consequently, data center operators are investing in high-performance switches that can support the growing volume of data traffic. This trend not only bolsters the Data Center Switch Market but also encourages innovation in switch design and functionality, as companies seek to optimize their infrastructure.

Rising Demand for High-Speed Connectivity

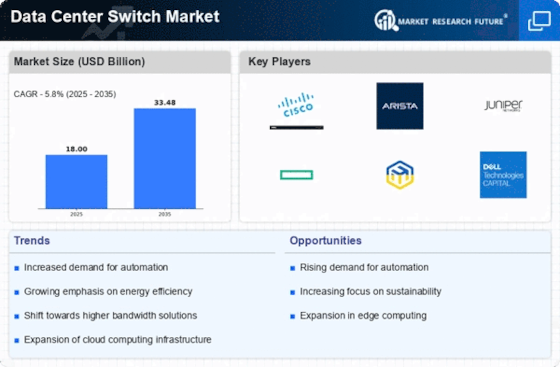

The Data Center Switch Market experiences a notable surge in demand for high-speed connectivity solutions. As organizations increasingly rely on data-intensive applications, the need for faster data transfer rates becomes paramount. This trend is evidenced by the projected growth of the data center switch market, which is anticipated to reach USD 20 billion by 2026. Enhanced connectivity not only facilitates seamless communication between devices but also supports the growing trend of remote work and digital collaboration. Consequently, manufacturers are focusing on developing advanced switching technologies that can handle higher bandwidths and lower latency. This shift towards high-speed connectivity is likely to drive innovation within the Data Center Switch Market, as companies strive to meet the evolving needs of their clients.

Adoption of Software-Defined Networking (SDN)

The Data Center Switch Market is experiencing a paradigm shift with the adoption of Software-Defined Networking (SDN). This technology allows for greater flexibility and control over network resources, enabling organizations to optimize their data center operations. The market for SDN-enabled switches is expected to grow by 30% in the coming years, driven by the need for agile and scalable networking solutions. SDN facilitates automation and simplifies network management, which is particularly beneficial for large enterprises with complex infrastructures. As a result, data center switch manufacturers are increasingly integrating SDN capabilities into their products, thereby enhancing their competitiveness in the Data Center Switch Market. This trend not only streamlines operations but also positions organizations to respond more effectively to changing business demands.