Market Trends

Introduction

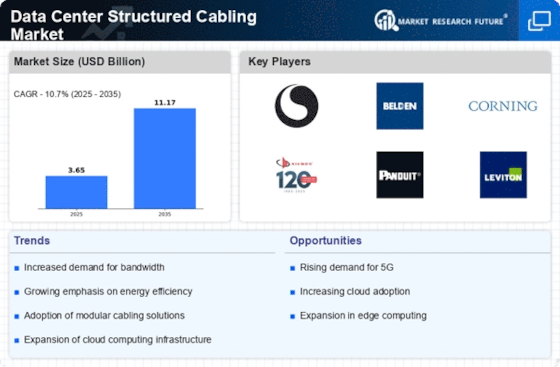

The Data Center Structured Cabling Market is experiencing significant transformation due to the impact of a number of macroeconomic factors such as rapid technological developments, increased regulatory pressures and changing consumer preferences. The shift to higher data transfer speeds and the adoption of cloud-based services are driving data center operators to invest in more efficient cabling solutions. The increasing regulatory pressures aimed at enhancing data security and energy efficiency are also influencing investment decisions. As organizations increasingly focus on scalability and flexibility, it is important for industry players to understand these trends so that they can align their offerings with the market demands and remain competitive.

Top Trends

-

Increased Demand for High-Speed Connectivity

High speed connection has been a requirement of the time. According to industry experts, the demand for higher data rates is driven by 5G technology and the Internet of Things. For example, it has been estimated that 5G networks could support up to one million devices per square kilometre, which in turn would call for advanced wiring solutions. The trend towards higher data rates is forcing manufacturers to keep improving their products to keep up with the changing needs of data centres. -

Sustainability and Eco-Friendly Solutions

In the data center industry, the environment is becoming a major concern, and companies are looking for green cabling solutions. For example, governments are imposing regulations that require data centers to reduce their carbon footprint. Studies show that energy-efficient cabling can reduce operating costs by up to 30 percent. And so, manufacturers are developing more sustainable products. -

Adoption of Modular Cabling Systems

Modular cable systems are gaining ground, because of their flexibility and scalability. In response to the rapid changes in technology and network architectures, companies are increasingly relying on these systems. According to a survey, 60 percent of operators of data centers prefer the flexibility of a modular system. This trend will certainly lead to innovations in the field of design and will make it easier to expand and scale in the future. -

Integration of Smart Technologies

INTELLIGENT TECHNOLOGY IS INTEGRATED INTO STRUCTURED CABLING SYSTEMS AND CHANGING THE MARKET LANDSCAPE. Data centers are deploying smart sensors and automation to enhance their monitoring and management capabilities. They’re reducing their energy consumption by up to 25%. Reports suggest that smart cabling systems can improve data center efficiencies by up to 50%. And this is only the beginning. As artificial intelligence and machine learning improve, the data center will become even more intelligent. -

Rise of Fiber Optic Cabling

For a number of reasons, fibre-optic cables are replacing the old copper wiring with greater speed and greater capacity. The fibre-optic industry is growing fast, driven by the need for high-speed data transmission. This trend is pushing manufacturers to invest in fibre-optic technology, which is bringing new products to market and increasing competition. -

Focus on Enhanced Security Solutions

With the ever-increasing sophistication of cyber attacks, the demand for greater security in structured cabling systems is growing. Among the most advanced security measures are encrypted cables and protected access points. According to a report, 70% of data breaches are caused by inadequate security measures. This trend is driving manufacturers to come up with more secure cabling solutions to ensure the integrity and security of data. -

Collaboration and Partnerships

Strategic alliances are becoming more common to enhance product offerings and market penetration. Between technology vendors and cable manufacturers, the development of integrated solutions is facilitated. These collaborations have led, for example, to the creation of advanced cabling systems designed to meet industry-specific requirements. This trend is likely to continue, resulting in greater innovation and a consequent growth in the market for structured cabling. -

Emphasis on Training and Skill Development

With the rapid evolution of technology, the training and professional development of cabling technicians has become increasingly important. Consequently, companies are investing in the training of their staff in order to provide them with the knowledge and skills required for the new applications. The result is a productivity increase of up to 20 per cent. This trend is likely to improve both the quality and the efficiency of services in the market. -

Regulatory Compliance and Standards

In the data center, compliance with regulatory requirements is becoming increasingly important. The government is establishing standards to ensure the safety and performance of cable connections. A survey shows that 75% of data center operators have the highest priority for compliance with industry standards. This trend is leading manufacturers to align their products with regulatory requirements, which could lead to higher quality and reliability in the market. -

Growth of Edge Computing

The development of edge computing is also influencing the structured cabling market. As data processing moves closer to the source, it requires a network that is able to accommodate this shift. It also needs cabling solutions that are designed to support a distributed architecture. Experts estimate that by 2025 edge computing will account for as much as 30 per cent of all data centre traffic. This trend is encouraging the cabling industry to develop specialised cable systems that meet the unique requirements of edge environments.

Conclusion: Navigating the Data Center Cabling Landscape

In 2023, the Data Center Structured Cabling Market will be characterized by a high degree of competition and a high degree of fragmentation, with both legacy and new players vying for market share. In terms of regional trends, the market is characterized by a rising focus on flexibility and on the importance of sustainable and flexible solutions. Strategic positioning is therefore essential for suppliers. They must use new capabilities such as artificial intelligence and automation to improve efficiency and customer satisfaction. With a focus on sustainable solutions, they will probably become the market leaders of the future and shape the data center cabling market.

Leave a Comment