Data Center Structured Cabling Size

Market Size Snapshot

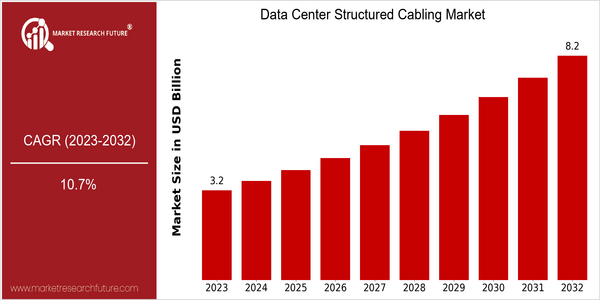

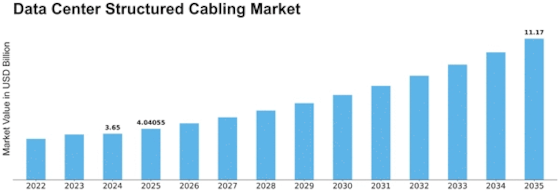

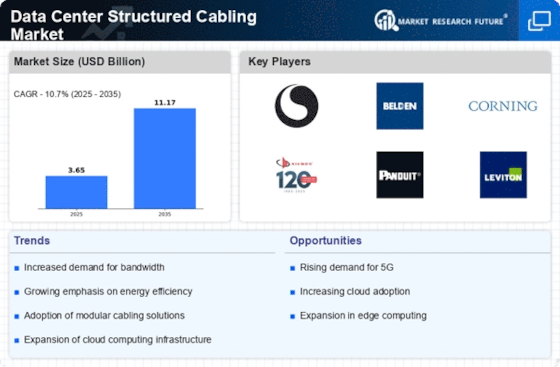

| Year | Value |

|---|---|

| 2023 | USD 3.25 Billion |

| 2032 | USD 8.25 Billion |

| CAGR (2024-2032) | 10.7 % |

Note – Market size depicts the revenue generated over the financial year

The Data Center Cabling Market is expected to reach $ 8.25 billion by 2032, at a CAGR of 10.7% from 2024 to 2032. This significant growth is due to the increasing demand for efficient and scalable data center networks, which is driven by the rapid development of cloud computing, big data and the Internet of Things. Since companies continue to invest in digital transformation, high-performance cabling solutions that can support higher bandwidth and faster data transmission are becoming more and more urgent. There are also several new technological trends driving the market, such as the transition to 5G, which requires the use of advanced cabling systems to meet the data transmission and connection needs of the 5G era. In addition, the development of edge computing is driving the data center to adopt more flexible and efficient cabling solutions to enhance the efficiency of data center operations. The key players in the market, such as Cisco, Commscope and Belden, have taken a variety of strategic measures, including forming strategic alliances and launching new products, in order to optimize their product offerings and capture more market shares. The recent heavy investment in R&D and the launch of the next-generation cabling system are indicative of the fierce competition between companies. Data center operators.

Regional Market Size

Regional Deep Dive

The Data Center Cabling Market is growing rapidly across all regions, driven by the rising demand for data centers and the need for efficient cabling solutions. In North America, the market is characterized by advanced technological development and a high concentration of data centers. In Europe, the market is characterized by regulatory compliance and the need for energy-efficient data center solutions. The Asia-Pacific region is rapidly expanding, driven by the growth of cloud computing and digital transformation, while in the Middle East and Africa, investments in data center infrastructure are being made as part of the overall diversification of economies. In Latin America, structured cabling solutions are gradually being adopted, driven by the growing telecommunications and Internet industries. Each region presents its own set of unique drivers and opportunities, influenced by factors such as technological development, regulatory frameworks, and economic conditions.

Europe

- The European market is seeing a rise in demand for structured cabling solutions due to the EU's stringent data protection regulations, which require enhanced data security measures in data centers.

- Key projects like the European Commission's Digital Single Market initiative are driving investments in digital infrastructure, including structured cabling, to support the region's digital economy.

Asia Pacific

- In Asia-Pacific, the rapid growth of cloud service providers such as Alibaba Cloud and AWS is leading to increased investments in data center infrastructure, including advanced structured cabling systems.

- Government initiatives in countries like India and Singapore are promoting the development of smart cities, which is further driving the demand for efficient cabling solutions in data centers.

Latin America

- Latin America is experiencing a digital transformation, with countries like Brazil and Mexico investing in telecommunications infrastructure, which is boosting the demand for structured cabling in data centers.

- The rise of local cloud service providers is prompting data center operators to upgrade their cabling systems to support higher bandwidth and connectivity needs.

North America

- The North American market is heavily influenced by major players such as Cisco Systems and CommScope, which are innovating in high-speed cabling solutions to meet the demands of 5G and IoT applications.

- Recent regulatory changes, particularly in energy efficiency standards, are pushing data center operators to adopt more sustainable cabling solutions, thereby enhancing the market's focus on eco-friendly technologies.

Middle East And Africa

- The Middle East is witnessing significant investments in data center projects, such as the Dubai Data Center, which is expected to enhance the region's connectivity and structured cabling capabilities.

- Regulatory frameworks in countries like Saudi Arabia are evolving to support the growth of the digital economy, leading to increased demand for structured cabling solutions in data centers.

Did You Know?

“Did you know that structured cabling can reduce installation time by up to 30% compared to traditional cabling methods, significantly lowering labor costs and improving efficiency?” — Telecommunications Industry Association (TIA)

Segmental Market Size

The Data Center Structured Cabling market is a critical market which supports the backbone of data center, and the data center cable market is growing steadily. The main driving force is the increasing demand for high-speed data transmission due to the popularity of cloud computing and big data, and the need for efficient and scalable network solutions. Regulations that ensure the security and compliance of data are also driving the demand for data center structured cabling systems. The data center structured cabling market is in a mature stage of development, and some companies such as Cisco and Schneider have already been able to establish advanced cabling solutions in large data centers in North America and Europe. Data centers in the enterprise, in the co-location, and in the telecommunications network are the main application areas of structured cabling. The structure of the cabling is to improve the interconnection and operational efficiency of data centers. The development of remote working and the growing emphasis on the green economy are also driving the market to grow. The development of fiber optic cables and the introduction of structured cabling systems will enable the transmission of data at higher speeds and better scalability.

Future Outlook

The Data Center Structured Cabling Market is poised for significant growth from 2023 to 2032. The market is expected to grow from $3.25 billion to $8.25 billion at a CAGR of 10.7%. This growth is primarily driven by the growing demand for high-speed data transmission and the growing popularity of cloud computing and virtualization. With the migration of business processes to the cloud, the need for scalable and flexible cabling solutions will increase. This will drive the investment in structured cabling systems in data centers worldwide. The introduction of 5G and the growth of the Internet of Things will further drive the market. These two technological trends will increase the demand for higher data rates and better connections. The growing focus on energy efficiency and sustainability in data center operations will also encourage the use of new cabling solutions that minimize energy consumption and optimize space. By 2032, structured cabling will account for a significant portion of the total investment in data center infrastructure. It is expected that the penetration rate will exceed 60% in new data centers, indicating the importance of structured cabling in future data center operations.

Leave a Comment