Growth of Edge Computing

The rise of edge computing is reshaping the Data Center Power Market. As organizations seek to process data closer to the source, the demand for smaller, localized data centers is increasing. This shift necessitates innovative power solutions tailored for edge environments, which often require high efficiency and reliability in limited spaces. The edge computing market is projected to grow at a compound annual growth rate of over 30% through 2025, indicating a substantial opportunity for power solution providers. Consequently, the Data Center Power Market must adapt to these evolving requirements to remain competitive.

Rising Demand for Data Processing

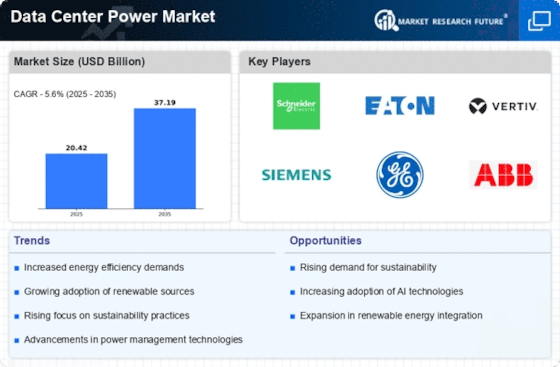

The Data Center Power Market experiences a notable surge in demand for data processing capabilities. As businesses increasingly rely on data analytics, cloud computing, and artificial intelligence, the need for robust data centers intensifies. According to recent estimates, the data center power consumption is projected to reach approximately 200 terawatt-hours annually by 2025. This escalating demand necessitates enhanced power solutions to ensure operational efficiency and reliability. Consequently, the Data Center Power Market is likely to witness significant investments in power infrastructure to accommodate this growing need, thereby driving innovation and competition among power solution providers.

Technological Advancements in Power Management

Technological advancements play a pivotal role in shaping the Data Center Power Market. Innovations in power management technologies, such as advanced cooling systems and energy-efficient power supplies, are becoming increasingly prevalent. These technologies not only enhance energy efficiency but also reduce operational costs. For example, the implementation of intelligent power distribution units can optimize energy usage, potentially leading to a 20% reduction in power consumption. As these technologies evolve, they are likely to drive the Data Center Power Market towards more sustainable and cost-effective solutions, appealing to a broader range of clients.

Increased Investment in Data Center Infrastructure

Investment in data center infrastructure is a critical driver of the Data Center Power Market. As digital transformation accelerates across various sectors, organizations are allocating substantial resources to enhance their data center capabilities. Reports indicate that capital expenditures on data center infrastructure are expected to exceed 200 billion dollars by 2025. This influx of investment is likely to spur advancements in power solutions, as companies seek to optimize energy consumption and improve overall efficiency. The Data Center Power Market stands to benefit significantly from this trend, as it aligns with the growing emphasis on operational excellence and sustainability.

Regulatory Compliance and Sustainability Initiatives

The Data Center Power Market is significantly influenced by regulatory compliance and sustainability initiatives. Governments and regulatory bodies are increasingly imposing stringent energy efficiency standards and carbon reduction targets. For instance, many regions have set ambitious goals to reduce greenhouse gas emissions by 30% by 2030. This regulatory landscape compels data center operators to adopt more sustainable power solutions, thereby fostering growth in the Data Center Power Market. Companies that proactively align with these regulations may gain a competitive edge, as they can attract environmentally conscious clients and reduce operational costs through energy-efficient practices.