Enhanced Fraud Detection

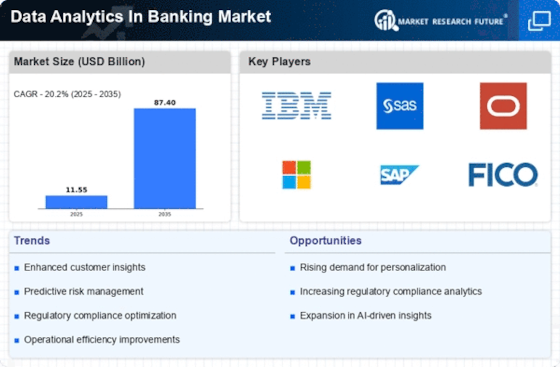

The Data Analytics In Banking Market is increasingly leveraging advanced analytics to enhance fraud detection capabilities. By employing machine learning algorithms and predictive analytics, banks can identify unusual patterns and behaviors that may indicate fraudulent activities. This proactive approach not only mitigates financial losses but also bolsters customer trust. According to recent data, financial institutions that utilize data analytics for fraud detection have reported a reduction in fraud-related losses by up to 30%. As the sophistication of cyber threats evolves, the demand for robust analytics solutions in the banking sector is likely to grow, driving innovation and investment in this area.

Personalized Banking Services

In the Data Analytics In Banking Market, the trend towards personalized banking services is gaining momentum. By analyzing customer data, banks can tailor their offerings to meet individual needs, preferences, and behaviors. This level of personalization enhances customer satisfaction and loyalty, as clients feel more valued and understood. Recent studies indicate that banks employing data analytics for personalization have seen a 20% increase in customer retention rates. As competition intensifies, the ability to provide customized services will likely become a key differentiator for banks, further propelling the adoption of data analytics solutions.

Risk Assessment and Management

Risk assessment and management are critical components of the Data Analytics In Banking Market. Financial institutions are utilizing data analytics to better understand and quantify risks associated with lending, investments, and market fluctuations. By employing sophisticated modeling techniques, banks can predict potential risks and develop strategies to mitigate them. Recent data suggests that banks using advanced analytics for risk management have improved their risk-adjusted returns by approximately 25%. As regulatory pressures increase and market conditions become more volatile, the reliance on data analytics for effective risk management is likely to intensify.

Regulatory Compliance Enhancement

The Data Analytics In Banking Market is also being shaped by the need for enhanced regulatory compliance. Financial institutions are increasingly turning to data analytics to ensure adherence to complex regulations and reporting requirements. By automating compliance processes and utilizing analytics to monitor transactions, banks can reduce the risk of non-compliance and associated penalties. Recent findings indicate that banks employing data analytics for compliance purposes have reduced their compliance costs by up to 40%. As regulatory environments continue to evolve, the demand for data analytics solutions that facilitate compliance is expected to grow.

Operational Efficiency Improvement

The Data Analytics In Banking Market is witnessing a significant push towards operational efficiency through the use of data analytics. By analyzing internal processes and customer interactions, banks can identify bottlenecks and streamline operations. This not only reduces costs but also enhances service delivery. For instance, banks that have implemented data-driven process improvements report a 15% reduction in operational costs. As financial institutions strive to optimize their resources and improve profitability, the integration of data analytics into their operational frameworks is expected to become increasingly prevalent.