Increased Regulatory Scrutiny

The dairy Testing Service Market is significantly influenced by heightened regulatory scrutiny surrounding food safety and quality. Governments and regulatory agencies are implementing stricter guidelines to ensure that dairy products meet safety standards, which has led to an increased demand for comprehensive testing services. This regulatory environment compels dairy producers to invest in testing services to avoid potential penalties and ensure compliance with food safety laws. Recent statistics indicate that the number of inspections and testing requirements for dairy products has risen by over 15% in the past few years. As a result, dairy testing service providers are expanding their capabilities to offer a wider range of tests, including microbiological, chemical, and nutritional analyses, to help producers navigate this complex regulatory landscape.

Consumer Awareness and Education

The Dairy Testing Service Market is also being shaped by increasing consumer awareness regarding food safety and quality. As consumers become more informed about the potential risks associated with dairy consumption, they are demanding transparency and assurance regarding the products they purchase. This heightened awareness is prompting dairy producers to prioritize quality assurance measures, including regular testing of their products. Surveys indicate that over 60% of consumers are willing to pay a premium for dairy products that are certified safe and tested for quality. Consequently, dairy testing service providers are responding by enhancing their marketing efforts to educate consumers about the importance of testing and the safety of dairy products. This trend is likely to drive further growth in the dairy testing services market as producers seek to meet consumer expectations.

Emerging Markets and Global Expansion

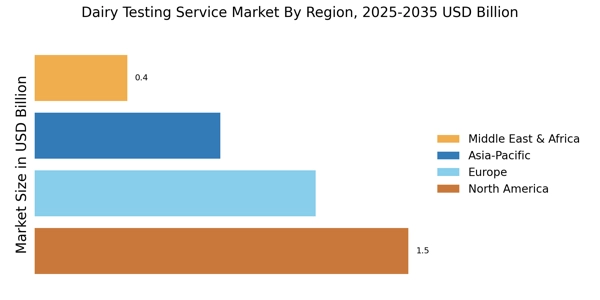

The Dairy Testing Service Market is poised for growth as emerging markets present new opportunities for expansion. Countries with developing dairy industries are increasingly recognizing the importance of quality testing to enhance their competitiveness in the global market. As these nations invest in modernizing their dairy sectors, the demand for reliable testing services is expected to rise. Recent reports suggest that regions such as Asia-Pacific and Latin America are experiencing rapid growth in dairy consumption, leading to a corresponding increase in the need for testing services. This trend indicates a potential market expansion for dairy testing service providers, who may need to tailor their offerings to meet the specific needs of these emerging markets. The growth in these regions could contribute to a more diversified and resilient dairy testing service market.

Rising Demand for Organic Dairy Products

The Dairy Testing Service Market is witnessing a surge in demand for organic dairy products, driven by changing consumer preferences towards healthier and more sustainable food options. As consumers become more health-conscious, they are increasingly seeking organic dairy products that are free from synthetic additives and hormones. This trend necessitates rigorous testing to ensure compliance with organic standards, thereby creating a robust demand for dairy testing services. According to recent data, the organic dairy market is expected to expand at a rate of approximately 10% annually, reflecting a significant shift in consumer behavior. Consequently, dairy testing service providers are adapting their offerings to cater to this growing segment, ensuring that organic products meet the stringent quality and safety standards required by consumers and regulatory bodies alike.

Technological Advancements in Testing Methods

The Dairy Testing Service Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as real-time testing and automation are enhancing the efficiency and accuracy of dairy testing processes. For instance, the introduction of advanced spectroscopic techniques allows for the rapid detection of contaminants and quality parameters in milk. This shift not only reduces testing time but also minimizes human error, thereby improving overall product safety. As a result, dairy producers are increasingly adopting these technologies to meet consumer demands for high-quality products. The market for dairy testing services is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 7% in the coming years. This growth is indicative of the industry's response to evolving consumer preferences and regulatory requirements.